Mortgage Calculator Canada

Mortgage Calculator Summary

If you purchase a house in Toronto, Ontario for $700,000 with a down payment of $140,000 and an interest rate of 2.5, you’ll have a monthly mortgage payment of $2,512. When you first purchase your home you will pay a $20,950 land transfer tax and pay annual property taxes of $4,200. Because your down payment is higher than 20% of the purchase price, you will have to pay for mortgage default insurance. The average monthly cost of home insurance for your property will be $25,500.

See Today’s Mortgage RatesMortgage calculator results: What do my payments look like?

To be a successful homeowner, you’ll need to reliably make your mortgage payments. Once you determine what your mortgage will cost, you can start budgeting for it and preparing your finances for what is sure to be a life-changing purchase.

Payments - First 5 Periods

| Period | Total Payment |

Principal Payment |

Interest Payment |

Ending Principal Balance |

|---|---|---|---|---|

| 1 | $1,345 | $1,166 | $12,160.44 | $558,654 |

| 2 | $2,512 | $1,348 | $1,163 | $557,306 |

| 3 | $2,512 | $1,351 | $12,160.44 | $12,160.44 |

| 4 | $2,512 | $1,354 | $12,160.44 | $12,160.44 |

| 5 | $2,512 | $1,356 | $12,160.44 | $12,160.44 |

Find a Mortgage

Mortgage rates change constantly. Take a look below to see how they’re trending today.

Data provided was obtained from the websites of the institutes listed. Rates are time sensitive and may change. Accordingly, there is no warranty that these rates are correct. Payments do not include amounts for taxes and insurance premiums. The actual payment obligation will be greater if taxes and insurance are included.

How does this mortgage calculator work?

The Money.ca mortgage calculator takes into account three factors: your original loan amount, or principal; the interest rate offered by your lender; and the total number of payments you’ll be required to make before reaching the end of your loan.

What determines the size of your mortgage payments?

Your mortgage payment will typically consist of principal and interest costs, although some loan products come with interest-only periods. If you’re required to buy mortgage default insurance, those premiums can sometimes be factored into your monthly payment as well.

Mortgage calculator definitions

An important part of the mortgage process is understanding how much the mortgage you need is going to cost you. Using a calculator like the one provided here can help you set realistic expectations as a homebuyer, which will make the white-knuckle experience of buying a home in Canada a little easier to handle.

-

Principal

The principal is the amount of money a homebuyer receives from a lender to purchase a property.

-

Mortgage Interest

Interest is the cost of borrowing money. The interest you pay will be based on a percentage of your principal.

-

Property Taxes

The amount a homeowner is expected to pay to support local government operations annually. If you're a new homeowner who has less than 20% equity in your home, you may be asked to pay your property taxes through your lender rather than directly to your local government.

-

Home Insurance

Home insurance is not legally required if you own your home outright, but you will need to secure home insurance if you want to get a mortgage.

-

Mortgage Default Insurance

If your down payment is less than 20%, you will need to purchase mortgage default insurance, which protects your lender in the event you default on your loan.

-

Land Transfer Tax

A land transfer tax (LTT), calculated as a percentage of a home's purchase price, is paid by the buyer when purchasing a property in Canada. Every province has an LTT. The amount varies in each province.

Click here to find the right mortgage for you!

Once you’ve used the mortgage calculator...

The size of the mortgage you’re ultimately approved for will be determined by your lender and its underwriting criteria. But there are a few things you’ll need to do before the lender can start crunching those numbers.

-

Ensure your credit is strong enough to appeal to lenders

Giving a borrower hundreds of thousands of dollars at a time is a huge financial risk for lenders, so they want to know that the people receiving the funds are likely to pay the money back. That’s why having a high credit score is so important in getting a lender on your side.

Credit scores range from 300 to 900, with a score of at least 680 generally considered “good” by most lenders. Get a free credit check now and see how you stack up against other borrowers.

-

Get pre-approved

There’s no point in going home shopping before you know how much you can actually spend. A mortgage pre-approval provides that clarity.

Getting pre-approved is a fairly straightforward process: You supply a lender with some basic information about your finances, and the bank or other financial institution tells you the maximum amount of money it will lend and the interest rate you can expect to pay. A pre-approval is typically in effect for 90 to 120 days.

Pre-approvals aren’t legally binding agreements, so what you’re pre-approved for may not wind up being the amount you actually receive from your lender.

-

Start considering the details

Once you have an idea of how much house you can afford, you should reserve a little brain power for the other factors that will determine how much your loan will cost you in the long-run.

You’ll need to choose between a fixed-rate or variable mortgage product. A fixed-rate mortgage means you will be paying the same amount of interest for the entirety of your mortgage term, making it a great option for borrowers on a strict budget. With a variable-rate mortgage, the amount of interest you pay can fluctuate depending on the behaviour of your lender’s prime rate.

Your term length, which can range from six months to a decade, determines when you can renew or refinance your loan. It’s an important decision. If you choose a five-year term, for example, but decide to sell your home halfway through your term, you could be on the hook for some truly brutal penalties for breaking your mortgage.

Your amortization period is the total length of time you’ll be given to pay off your mortgage. It maxes out at 25 years with most lenders. With a longer amortization period, your monthly payments will be smaller but your total interest costs will be higher.

You should also prepare to choose between an open or closed mortgage product. An open mortgage allows you to make extra payments to pay off your loan early, while a closed mortgage comes with a prepayment penalty.

-

Find a mortgage adviser you trust

A mortgage is like an insanely complicated 3D puzzle. Putting the pieces together requires levels of expertise and experience most people simply don’t have. That’s why finding a mortgage adviser who can customize a solution to your unique financial situation is a critical step in the mortgage journey.

A good mortgage broker will take into consideration your long-term financial goals and put you into a loan that helps you achieve them. Interview several brokers until you find one you’ll feel comfortable with. Keep in mind that you’ll be sharing a lot of personal and financial details.

Find the right mortgage lender today

How to lower your costs using our mortgage calculator

Even though the size of your mortgage will largely be dictated by the price of your home and the mortgage rate you’ll be paying, there are multiple steps you can take to lower the size of your mortgage payments.

-

1. Improve your credit score.

The lowest mortgage rates go to borrowers with the best credit, so if you can add a few points here and there by paying down outstanding debts and rectifying any other credit issues that might be gumming up the works, it can be well worth the effort. Improve your credit score.

-

2. Make a bigger down payment.

If you’re able to put more money down upfront, you will shrink the amount you’ll need for your home loan. Plus, if you’re able to put together a down payment worth 20% or more of your home’s value, you will escape having to pay any expensive mortgage insurance premiums.

-

3. Extend your amortization period.

If you’re in a position to do so, extending your amortization period will allow for smaller monthly payments.

-

4. Find a lower mortgage rate.

Whether you’re buying or refinancing, finding a lower rate can dramatically lower your monthly mortgage payment.

Don’t let one of today’s low mortgage rates slip through your fingers.

Mortgage taxes and fees in Canada

Not all provinces treat mortgages the same.Take a look at the chart below to see if the province you’re shopping in will require you to pay more.

| PST on mortgage insurance? |

Land transfer taxes? |

Land transfer rebate? |

|

|---|---|---|---|

| British Columbia | |||

| Alberta | |||

| Saskatchewan | |||

| Manitoba | |||

| Ontario | |||

| Quebec | |||

| New Brunswick | |||

| Nova Scotia | |||

| Prince Edward Island | |||

| Newfoundland and Labrador | |||

| Yukon | |||

| Nunavut | |||

| Northwest Territories |

Don’t let one of today’s low mortgage rates slip through your fingers.

Frequently Asked Questions (FAQ)

-

What is mortgage default insurance?

+If you can’t assemble a 20% down payment, you will be required to pay mortgage insurance to protect your lender in the event you can no longer make your mortgage payments. Paying the insurance is a drag, but it can allow you to get into a home by putting as little as 5% down.

You’ll purchase your insurance through the Canada Mortgage and Housing Corporation, a government department that acts as Canada’s housing agency, or from one of two private providers. None of the three provide loan insurance for homes that cost over $1 million.

Mortgage insurance is calculated as a percentage of your mortgage and is based on the size of your down payment. You can pay it in a lump sum or add it to your mortgage and include it in your payments.

-

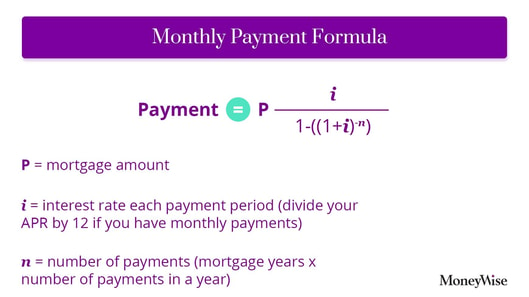

How do you calculate monthly mortgage payments

+- Determine your principal. That’s the amount you’re borrowing before interest charges are added.

- Calculate your monthly interest rate by dividing the annual interest rate by 12. If your annual interest rate is 3%, your monthly rate would be 0.25%.

- Calculate the number of payments by multiplying the length of your mortgage in years by 12. A 25-year mortgage would consist of 300 payments.

- Once you have your figures, plug them into the following equation:

PMT = (P)*(i/(1-((1+i)-n)))

PMT = your mortgage payment

P = your principal

i = the monthly interest rate

n = number of months needed to pay back the loan

-

What is a mortgage broker?

+A mortgage broker acts as a liaison between you, the borrower, and the lender who provides you with the money for your home. Brokers don’t lend their own money. They simply make your case to lenders — and vice versa — as a means of finding a fit that works for both parties.

-

How do payments differ by province in Canada?

+They don’t. Canada’s lending rules apply to every province. Differences in rate and loan conditions are determined by individual lenders, not geography.

-

What is an amortization schedule?

+An amortization schedule is a detailed table that shows precisely how much of your monthly mortgage payment goes toward interest and how much is put toward your principal for the entire length of the loan.

Mortgage Rate News

Read the latest on mortgage rates, the trends that shape them and the strategies that can save you money on your next home loan.

Sources

The publicly available sources that were used are as follows:

Average Home Price (As at July 2021)

The Canadian Real Estate Association https://www.crea.ca/

Home Insurance

J.D. Power, 2018 Canada Home Insurance Study https://canada.jdpower.com/sites/canada/files/2018094_canada_home_insurance_study.pdf

Default Insurance (Sometimes referred to as CMHC insurance)

Annual Property Tax Rate (As at 3 June 2021)

Alberta https://www.calgary.ca/cfod/finance/property-tax/tax-bill-and-tax-rate-calculation/current-property-tax-rates.html

British Columbia http://www.calculconversion.com/property-tax-calculator.html

Manitoba https://www.gov.mb.ca/edupropertytax/index.html

New Brunswick https://www2.gnb.ca/content/gnb/en/departments/finance/taxes/real_property.html

Newfoundland and Labrador http://www.stjohns.ca/living-st-johns/newcomers/getting-settled/banking-and-taxes

Nova Scotia https://www.halifax.ca/home-property/property-taxes/tax-rates

Ontario https://www.fin.gov.on.ca/en/consultations/landtaxreform/

Prince Edward Island https://www.princeedwardisland.ca/en/topic/tax-administration-and-property-records

Quebec https://montreal.ca/en/articles/how-municipal-taxes-are-calculated-8962

Saskatchewan https://www.regina.ca/home-property/residential-property-tax/property-tax/

Land Transfer Tax

British Columbia https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax

Manitoba https://www.gov.mb.ca/finance/other/landtransfertax.html

New Brunswick http://www.legal-info-legale.nb.ca/en/planning_for_buying_a_house#:~:text=In%20New%20Brunswick%2C%20the%20land,the%20tax%20payable%20is%20%241000

Newfoundland and Labrador https://designmymove.com/land-transfer-taxes-in-newfoundland-labrador/

Nova Scotia https://novascotia.ca/sns/access/land/deed-transfer-property-tax.asp

Ontario https://www.fin.gov.on.ca/en/bulletins/ltt/2_2005.html

Prince Edward Island https://www.princeedwardisland.ca/en/information/finance/real-property-transfer-tax-rate

Quebec https://www.oaciq.com/en/articles/property-transfer-duties

Yukon https://www.cmhc-schl.gc.ca/en/consumers/home-buying/buying-guides/condominium/provincial-fact-sheets/Yukon-Fact-Sheet