The best dividend stocks in Canada

Sutthiphong Chandaeng / Shutterstock

Updated: August 14, 2023

Looking for a bit of safety in insecure times? Many investors are looking for the best dividend stocks as a form of insurance since they come primarily courtesy of Canadian blue-chip companies with a record of being solid businesses. This article points the way to top dividend performers worth considering.

Dividend investing is one of the most popular investment strategies. Investors love to see a steady stream of monthly or quarterly dividends paid into their portfolios. Not all companies pay dividends, but the ones that do tend to be larger, more established blue-chip stocks. They use company earnings to pay dividends to shareholders rather than putting that money back into their business to invest in new projects or research and development.

But what are the best dividend stocks? And how do you get started with dividend investing? Keep reading to learn more.

Start investing with QuestradeDividend investing basics

Before you invest in dividend stocks it’s important to understand two things about dividends:

- Dividends make up just one part of a stock’s total return (the other being its capital appreciation).

- When a company pays a dividend its stock price will fall by the amount of the dividend paid. That’s a mathematical certainty since the dividends are paid from company earnings and therefore reduce the total value of the company.

The best way to buy dividend stocks is through an online broker. Wealthsimple Trade account fits the bill nicely with its commission-free trading platform. Free trades make it easy and affordable to build your own dividend stock portfolio. Plus, Wealthsimple Trade will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

Questrade is another solid option and is our top pick for the best Canadian online brokerage. It has a more robust trading platform, including desktop access and more available account types, and stock buys cost just $4.95.

With that out of the way, let’s look at the best dividend stocks in Canada. Our stock market is heavily tilted towards financials, energy, telecom, and utilities. Dividend investors will find most of the best dividend stocks in these categories.

Start investing with Wealthsimple TradeThe best dividend stocks in Canada

Back in my dividend stock picking days, I would look at a number of metrics before buying shares in a company. I liked stocks with a high dividend yield, but not too high for the payout ratio to signal trouble. I liked companies that were value-priced, meaning they were trading at a low price to earnings. I liked large-cap companies, also known as blue-chip stocks. Finally, I liked stocks with a strong track record of growing their dividend every year.

With those characteristics in mind, here are the best dividend stocks in Canada:

Power Corp of Canada (POW-T)

Power Corp is a holding company with controlling interests in Great-West Lifeco (insurance) and IGM Financial (investment management). Its stock price has struggled in recent years, but the company trades at a price-earnings ratio of just 11.38, making it a relatively cheap buy. The dividend yield is an attractive 6.12%, and Power Corp has increased its dividend for five consecutive years.

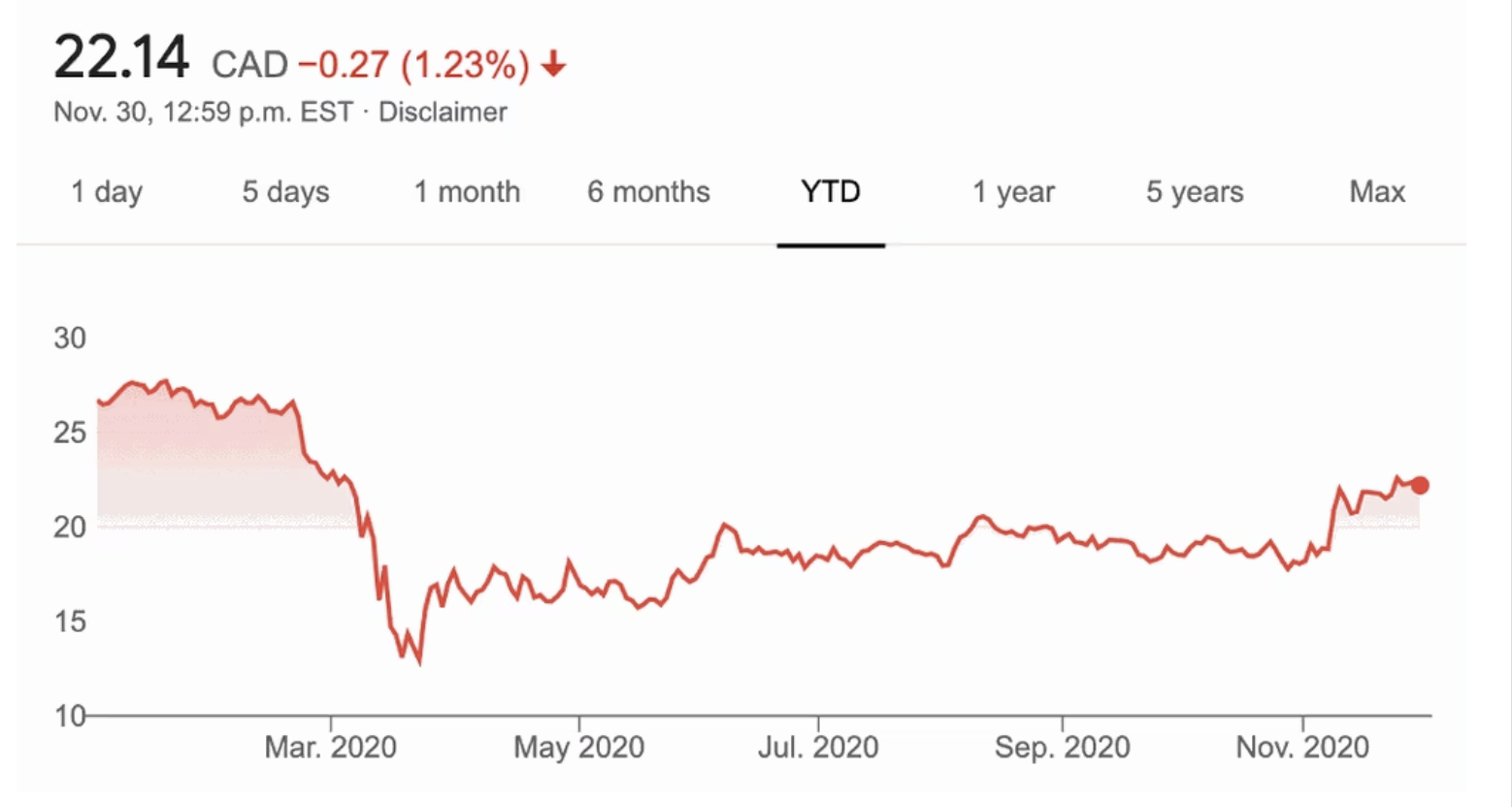

Bank of Nova Scotia (BNS-T)

Scotiabank is known as Canada’s “international” bank, with operations in Central and South America, in addition to its core financial services offerings across Canada. It trades at a price-earnings ratio of 11.21 after a relatively flat performance in the past five years. Scotiabank’s dividend yield is 5.72%, and it has increased its dividend for nine consecutive years.

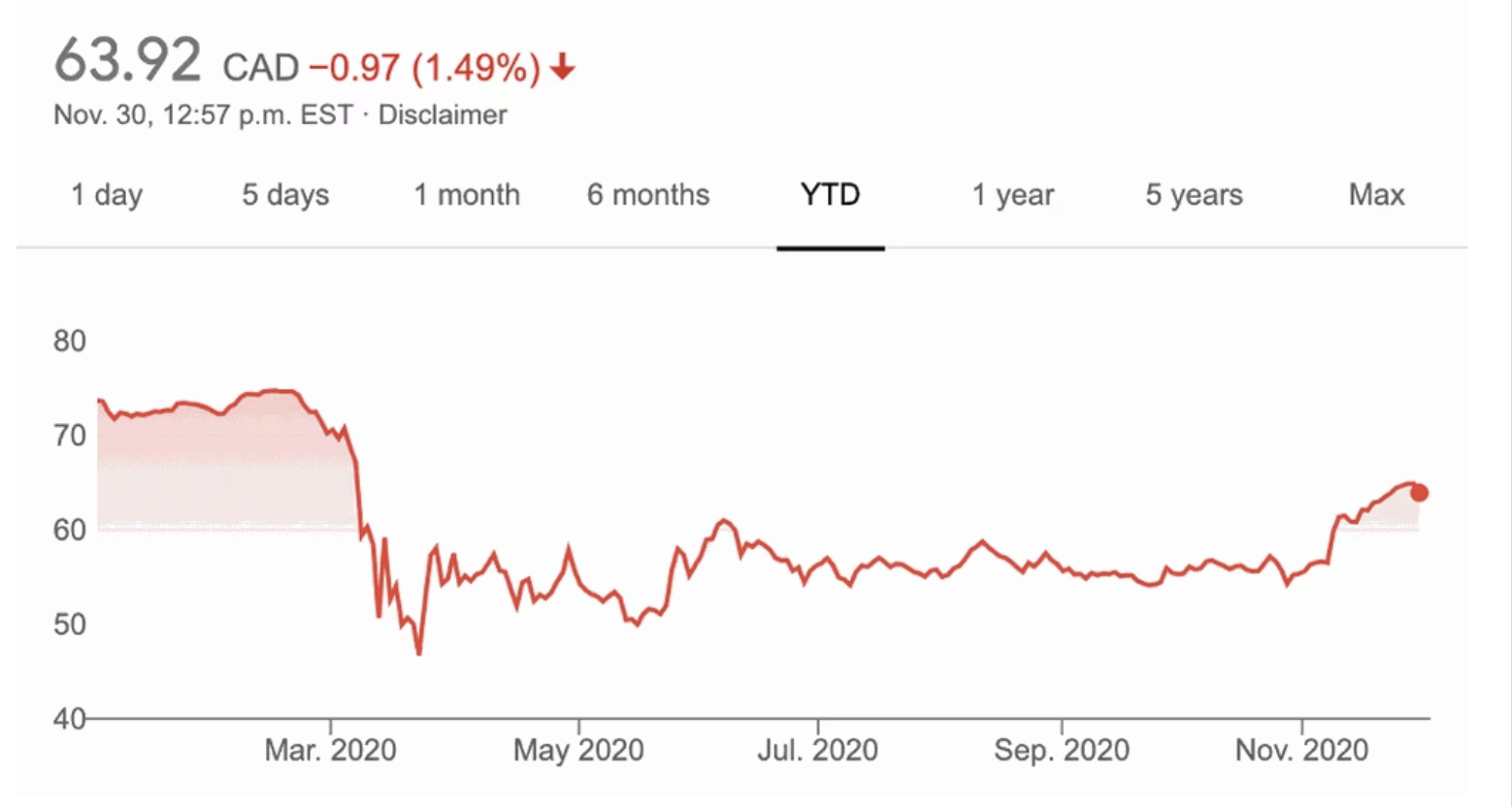

Pembina Pipelines (PPL-T)

Pembina Pipelines is – you guessed it – a pipeline company with more than 10,000 kilometres of pipelines across North America. Pembina’s stock has had a rough 2020, but its performance is positive over the past five years. It trades at a price-earnings ratio of 19.68. Pembina stock has a juicy dividend yield of 8% and has increased its dividend for nine consecutive years.

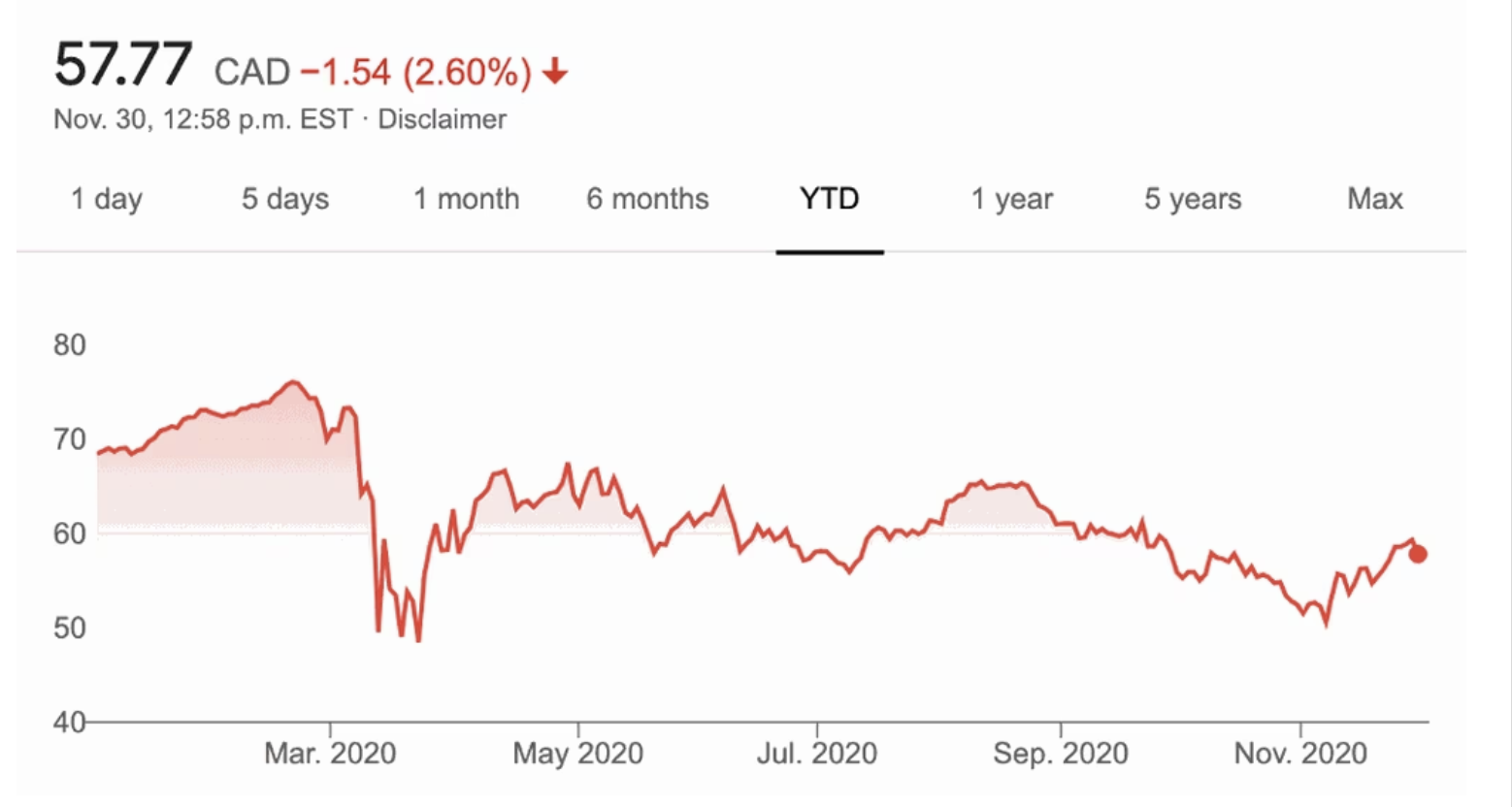

TC Energy (TRP-T)

TC Energy (formerly TransCanada Pipelines) operates pipeline and power generation assets in Canada, the U.S., and Mexico. Its pipeline network consists of nearly 100,000 kilometres of natural gas pipeline. TC Energy has a positive 5-year return (30%) and currently trades at a price-earnings ratio of 11.73. Its dividend yield is 5.84% and TC Energy has increased its dividend for 16 consecutive years.

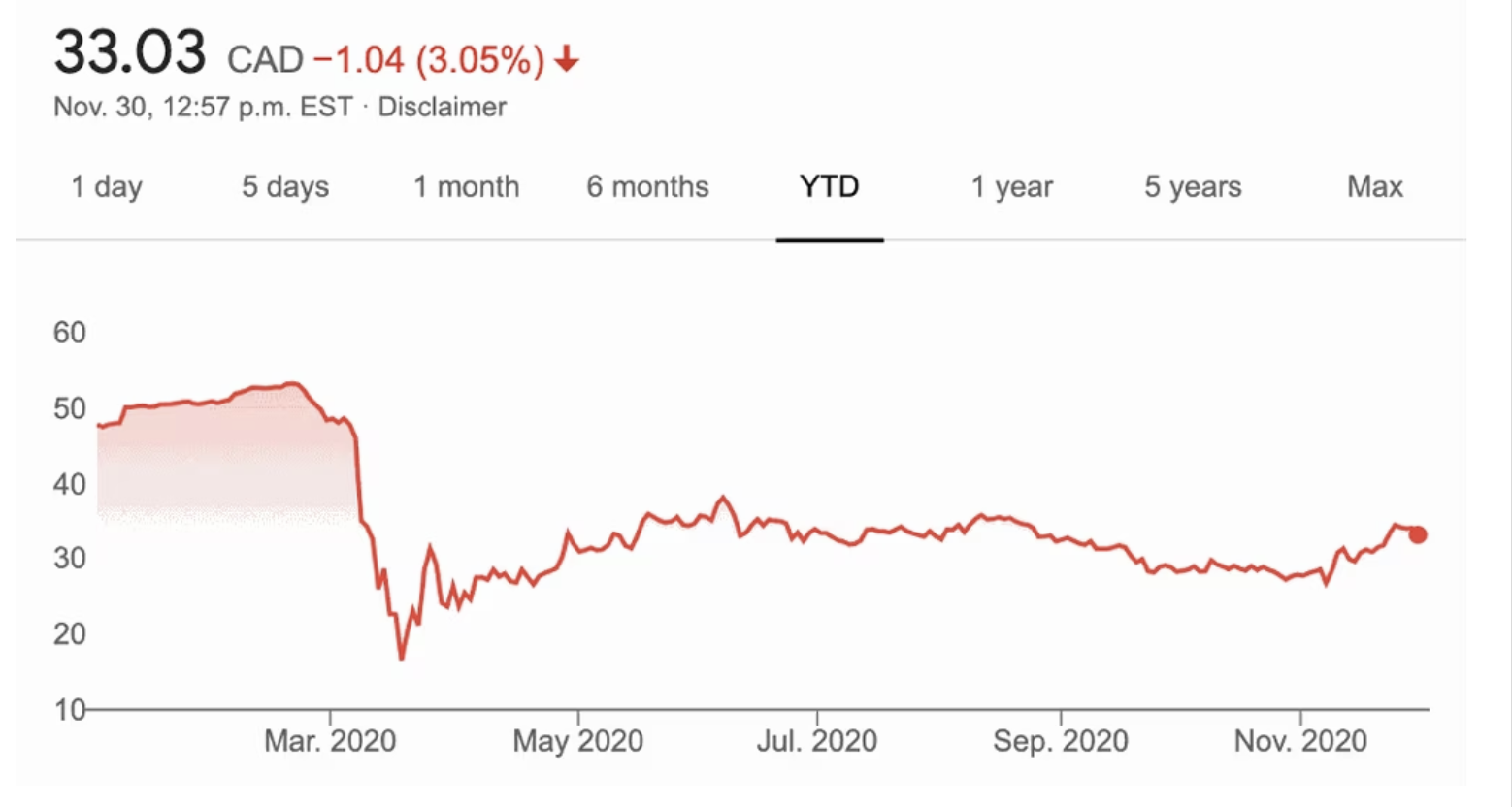

Manulife (MFC-T)

Manulife is another insurance and wealth management provider, with assets under management totalling more than 1.2 trillion. Manulife’s share price has been flat over the past 5 years, giving it an attractive price-earnings ratio of just 8.21. The company famously cut its dividend in 2009 but has since rebounded to post six consecutive years of dividend growth. Its current dividend yield is 5.15%.

What makes these five dividend stocks stand out is their combination of low price-to-earnings ratios, low price-to-book ratios, high dividend yields, and sustainable dividend payout ratios. These characteristics scream “value” to dividend-focused investors looking to build their portfolios with safe and dependable blue-chip stocks.

That said, some dividend investors look for dividend stocks with a specific set of criteria, like a high dividend yield or a long history of annual dividend increases. Our next two sections will look at the highest yield dividend stocks in Canada, plus the top 10 dividend growth stocks in Canada.

Top 10 high yield dividend stocks in Canada

Indeed, many investors are simply drawn to stocks with a high dividend yield. Retirees often want to derive income from their investment portfolio and stocks with a high dividend yield are a good way to boost your retirement income.

Here’s a look at the top 10 high-yield dividend stocks in Canada:

The trouble with high-yield dividend stocks is that there is no guarantee the dividend payout will remain sustainable. A high dividend yield often signals that the share price has fallen. The dividend may be at risk of being reduced or eliminated if the trend continues, or the situation doesn’t improve.

Indeed, several dividend stocks on the above list are currently paying out more in dividends than their earnings can support. These stocks include Brookfield, Cdn Natural Resources, Enbridge, Pembina Pipelines, and BCE.

One trick is to screen out any high dividend-yielding stocks that have a dividend payout ratio above 100%, meaning they’re paying out more cash than they’re bringing in.

Top 10 dividend growth stocks in Canada

Instead of picking dividend stocks with the highest yield, some dividend investors prefer stocks with lower dividend payout ratios but also have a long history of increasing their dividends each year.

These dividend growers, also known as dividend aristocrats, are typically blue-chip stocks that are leaders in their respective industries and that have a wide “moat” around their operation that makes their business difficult to disrupt.

Here are the top 10 dividend growth stocks in Canada, along with their streak of raising their dividends:

Some of the companies on this list have a dividend yield under 2%. Don’t be fooled by the relatively low yield. These companies have had an incredible track record of increasing their dividends every single year for decades. A lower yield, plus a lengthy history of paying increasing dividends can signal a strong company that balances the need to reinvest and grow their business with the desire to reward shareholders with dividends.

Take Fortis, which has the second-longest consecutive dividend growth streak in Canada. It’s a utility company with reliable revenues and enough cash to constantly reinvest in its business and acquire new businesses as needed. Its shareholders have been rewarded handsomely with dividend increases every year like clockwork. It’s about as dependable a company as one could possibly invest in.

On the other hand, Metro is a grocery retailer with operations across Canada. Grocery stores have notoriously thin margins, but Metro has managed to increase its dividends every year for nearly a quarter of a century.

While its dividend yield is below 2%, Metro’s share price has seen an annual compound growth rate of 17.31% over the past eight years, compared to Fortis, which has seen compound annual growth of just 5.77% over the same period.

Risks and benefits of investing in dividend stocks

Dividend stocks have had a good track record of beating the broad market index (like the TSX). That has less to do with the company’s dividend policy and more to do with the fact that a typical dividend growth stock has exposure to known risk factors like value, size, and profitability – factors that explain stock returns.

Furthermore, investing in individual stocks is risky, whether the company pays a dividend or not. Long-time safe “widow-and-orphan” stocks like General Electric (GE) have seen rapid price declines and have reduced or eliminated their dividend entirely. Oil and gas stocks were routed in 2015 when the price of oil collapsed, with many companies slashing their dividends in response.

Finally, investing in Canadian dividend-paying stocks restricts you to a small subset of a country that only makes up 3% of the global stock market. Canada’s highly concentrated stock market could see sustained periods of underperformance compared to other markets around the world. Investing in low-cost, globally diversified index funds is likely the most sensible long-term approach.

Still, many dividend investors find comfort in receiving quarterly dividends – whether they reinvest the proceeds or spend the cash. The steady income keeps dividend investors focused on the big picture and prevents them from panicking and selling in a downturn. That’s a good thing.

For retirees who need the income, dividend stocks can pay out enough cash to meet your spending needs while also providing the potential for capital appreciation. Many retirees can’t stand the idea of selling shares to generate retirement income, so they look to dividend stocks to provide the income they need (even though there is no difference between selling $1000 worth of shares and receiving $1000 worth of dividends – both reduce the market value by $1,000).

How to choose the dividend stock for you

I’ve shown you how to screen stocks for the highest dividend yield, and why that might be problematic. I’ve listed companies with the longest track record of increasing their dividend payments every year, and why this might be a better metric to use for long-term investing. Now, how do you put it all together and choose the right dividend stocks for your portfolio?

One approach that I’ve found useful is to skim the holdings of some of the top dividend ETFs. The iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (CDZ) offers exposure to a portfolio of high-quality Canadian dividend stocks that have increased dividends for five consecutive years or more.

This type of dividend screening allows a do-it-yourself investor to “skim” off the top of a dividend ETF’s holdings and build their own dividend stock portfolio without paying the associated fees that come with holding an ETF. The MER on CDZ is 0.66%.

Whether you look for high dividend yield stocks, dividend stocks with a history of increasing their dividends, or use some other dividend evaluation metric, be sure to diversify across sectors and potentially outside of Canada as well. The U.S. has a much larger and more diverse stock market that includes dividend stocks with a much longer history of paying and increasing their dividends.

Read: Why and how to drip: dividend re-investment plans

Final thoughts

Dividend investors had their mettle tested in 2020 when the Covid-19 pandemic caused markets to crash earlier this year. And, while stocks came roaring back, the rally was led by technology companies like Amazon and Netflix that don’t pay dividends.

Dividend stocks have struggled to keep up with the broader stock market this year, making it challenging for dividend investors to stick to their plans. Indeed, the Canadian dividend aristocrats index (represented by CDZ) is down 18% year-to-date, while the TSX (represented by XIU) is down just 8.4% on the year.

The competition is much closer in the U.S., where the U.S. dividend appreciation index (represented by VGG) is up 2.2% on the year while the S&P 500 (represented by VFV) is up 3% year-to-date.

No matter which dividend stock investing strategy you choose, make sure you select the right discount brokerage platform that suits your needs. Wealthsimple Trade offers commission-free stock and ETF trading on its platform, while Questrade allows you to trade for as low as $4.95 per transaction (and free ETF purchases).

New to investing? Get a crash course with our How to start investing in Canada.

Robb Engen is a leading expert in the personal finance realm of Canada and is also the co-founder of Boomer & Echo, an award-winning personal finance blog.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.