-1691529115.jpg)

How to avoid credit card fees in Canada

Rawpixel.com / Shutterstock

Maybe you think credit card fees are as inevitable as that old idiom about death and taxes. Used wisely, your credit card is a financial tool. Plus, there are some pretty sweet perks to having a piece of plastic in your back pocket – managing cash flow, travel rewards, comprehensive insurance, and consumer protection. After all, how else are you going to afford that suite overlooking the Vegas strip?

But credit cards can also come with some hefty charges. It pays to know what fees are associated with credit cards, and even ask yourself: is it worth it to pay an annual fee for a credit card? (Depending on what you want from your credit card, the answer may be yes) Even if you’re the type of person who pays off their balance each month, there are other credit card charges you may not be aware of, as well as some tricks to avoid paying the fees. Here is how to avoid credit card fees – and our recommendations for the best credit cards to help you.

Annual fees

Tangerine Money-Back Credit Card

5.0

10% back

Welcome offerGood

Suggested credit scoreGet 10% cash back on up to $1,000 in everyday purchases made within 2 months. Pay only 1.95% balance transfer interest for the first 6 months.

Expires

Nov 1, 2024

Pros

-

No annual fee

-

Choose the spending categories where you want to earn the most cash back

-

Unlimited cash back—no maximum spending limit for any purchase category

-

Cash back is paid out monthly rather than annually

-

Periodically includes a special welcome offer where you can get extra cash back

-

1.95% interest on balance transfers for the first 6 months (1% transfer fee applies)*

Cons

-

Regular cash back rates are still lower than what you can get from a card with an annual fee

-

Limited extra perks or benefits beyond the cash back and balance transfer promotion

-

Generally not a good fit for shopping at warehouse clubs or wholesale grocers like Costco or Walmart

-

Tangerine does not have any physical bank branches

Eligibility

Good

Recommended Credit Score

$12,000

Required Annual Personal Income

Recommended Credit Score

Good

Required Annual Personal Income

$12,000

2%

Earn 2% cash back on 2 categories of your choice (e.g. groceries, recurring bills, gas, drug stores, etc.)

3

Get a Tangerine Savings account and add a 3rd 2% cash back category.

0.5%

Earn 0.50% on all your other everyday purchases.

Earn 2% cash back on 2 categories of your choice (e.g. groceries, recurring bills, gas, drug stores, etc.)

2%

Get a Tangerine Savings account and add a 3rd 2% cash back category.

3

Earn 0.50% on all your other everyday purchases.

0.5%

19.95% - 24.95%

Variable APR

1.95%

Balance Transfer Rate 1.95% interest for first 6 months, 19.95% after that.

19.95%

Cash Advance APR $3.50 within Canada, $5.00 outside Canada

$0

Annual Fee $0 for additional cardholders

2.50%

Foreign Transaction Fee

Variable APR

19.95% - 24.95%

Balance Transfer Rate

1.95%

Cash Advance APR

19.95%

Annual Fee

$0

Foreign Transaction Fee

2.50%

Pros

-

No annual fee

-

Choose the spending categories where you want to earn the most cash back

-

Unlimited cash back—no maximum spending limit for any purchase category

-

Cash back is paid out monthly rather than annually

-

Periodically includes a special welcome offer where you can get extra cash back

-

1.95% interest on balance transfers for the first 6 months (1% transfer fee applies)*

Cons

-

Regular cash back rates are still lower than what you can get from a card with an annual fee

-

Limited extra perks or benefits beyond the cash back and balance transfer promotion

-

Generally not a good fit for shopping at warehouse clubs or wholesale grocers like Costco or Walmart

-

Tangerine does not have any physical bank branches

Eligibility

Good

Recommended Credit Score

$12,000

Required Annual Personal Income

Recommended Credit Score

Good

Required Annual Personal Income

$12,000

2%

Earn 2% cash back on 2 categories of your choice (e.g. groceries, recurring bills, gas, drug stores, etc.)

3

Get a Tangerine Savings account and add a 3rd 2% cash back category.

0.5%

Earn 0.50% on all your other everyday purchases.

Earn 2% cash back on 2 categories of your choice (e.g. groceries, recurring bills, gas, drug stores, etc.)

2%

Get a Tangerine Savings account and add a 3rd 2% cash back category.

3

Earn 0.50% on all your other everyday purchases.

0.5%

19.95% - 24.95%

Variable APR

1.95%

Balance Transfer Rate 1.95% interest for first 6 months, 19.95% after that.

19.95%

Cash Advance APR $3.50 within Canada, $5.00 outside Canada

$0

Annual Fee $0 for additional cardholders

2.50%

Foreign Transaction Fee

Variable APR

19.95% - 24.95%

Balance Transfer Rate

1.95%

Cash Advance APR

19.95%

Annual Fee

$0

Foreign Transaction Fee

2.50%

Many banking institutions charge for the honour of carrying their card in your wallet. Annual credit card fees can vary widely, depending on the product. While fee-carrying credit cards often come with perks such as travel rewards, roadside assistance, or a concierge service, if these things don’t matter to you, why pay an annual fee at all?

The Tangerine Money-Back Credit Card is one of the best no annual fee credit cards on the market. Applicants only require a minimum personal income of $12,000 and are recommended to have at least a Fair;Good credit score. Another perk is the cash back rewards. Earn 2% Money-Back Rewards on your purchases in up to 3 categories of your choice, and 0.50% Money-Back Rewards on all other purchases.

Tangerine pays out rewards monthly – either applied to the balance of your credit card or directly into a Tangerine Savings Account. Not only can you save money, but you’re also not paying an annual fee for the privilege.

*Terms and conditions apply

Interest charges

In an ideal world, the easiest way to avoid credit card fees is to pay off your statement in full and avoid interest charges. But sometimes life gets in the way, and you find yourself carrying a balance. Credit cards typically come with a 19.99% interest rate. So, it makes sense to avoid additional credit card charges and switch to one of the best low-interest credit cards in Canada.

READ MORE: The best low-interest rate credit cards.

Foreign transaction fees

Let’s face it – travelling can be expensive. On top of paying for air travel and accommodation, there’s a hidden expense that you may not be aware of: foreign transaction fees. Foreign transaction fees are charged by your credit card company when you make purchases outside Canada or with a non-Canadian retailer. The fees—around 2 to 3 percent—are usually incorporated into the exchange rate, so they’re not always noticeable. But they can add up, especially if you’ve got the itch to wander, are planning to study abroad, or are an entrepreneur who makes online purchases in foreign currencies.

Scotiabank Passport® Visa Infinite* Card

3.6

up to 35K pts

Welcome offerExcellent

Suggested credit scoreEarn up to $1,100* in value in the first 12 months, including up to 35,000 bonus Scene+ points

Expires

Nov 1, 2024

Pros

-

No FX fees means the card saves you significant expenses on foreign transaction fees

-

Earn up to 3x Scene+ points per $1 spent on eligible purchases

-

Flexible and straightforward redemption program

-

Visa acceptance globally compared to American Express, especially outside major cities.

-

Enjoy six annual visits to airport lounges

-

Robust insurance offerings, including extended travel emergency medical coverage

-

Access to Visa Infinite Program benefits, with added advantages like a free supplementary card

Cons

-

High annual fee

-

Limited rewards categories for earning reward max rate on purchases

-

Primarily best for travel within Canada

Eligibility

Excellent

Recommended Credit Score

$60,000

Required Annual Personal Income

$100,000

Required Annual Household Income

Recommended Credit Score

Excellent

Required Annual Personal Income

$60,000

Required Annual Household Income

$100,000

3x

Scene+ points¹ on every $1 you spend at Sobeys, Safeway, IGA, Foodland and participating Co-ops and more

2x

Scene+ points¹ for every $1 you spend on other eligible grocery stores, dining, eligible entertainment purchases and eligible daily transit options (including ride shares, buses, subways, taxis and more)

1x

Scene+ point for every $1 spent on all other eligible everyday purchases

Scene+ points¹ on every $1 you spend at Sobeys, Safeway, IGA, Foodland and participating Co-ops and more

3x

Scene+ points¹ for every $1 you spend on other eligible grocery stores, dining, eligible entertainment purchases and eligible daily transit options (including ride shares, buses, subways, taxis and more)

2x

Scene+ point for every $1 spent on all other eligible everyday purchases

1x

20.99%

Purchase APR

22.99%

Balance Transfer Rate

22.99%

Cash Advance APR

$150

Annual Fee

0.00%

Foreign Transaction Fee

Purchase APR

20.99%

Balance Transfer Rate

22.99%

Cash Advance APR

22.99%

Annual Fee

$150

Foreign Transaction Fee

0.00%

Pros

-

No FX fees means the card saves you significant expenses on foreign transaction fees

-

Earn up to 3x Scene+ points per $1 spent on eligible purchases

-

Flexible and straightforward redemption program

-

Visa acceptance globally compared to American Express, especially outside major cities.

-

Enjoy six annual visits to airport lounges

-

Robust insurance offerings, including extended travel emergency medical coverage

-

Access to Visa Infinite Program benefits, with added advantages like a free supplementary card

Cons

-

High annual fee

-

Limited rewards categories for earning reward max rate on purchases

-

Primarily best for travel within Canada

Eligibility

Excellent

Recommended Credit Score

$60,000

Required Annual Personal Income

$100,000

Required Annual Household Income

Recommended Credit Score

Excellent

Required Annual Personal Income

$60,000

Required Annual Household Income

$100,000

3x

Scene+ points¹ on every $1 you spend at Sobeys, Safeway, IGA, Foodland and participating Co-ops and more

2x

Scene+ points¹ for every $1 you spend on other eligible grocery stores, dining, eligible entertainment purchases and eligible daily transit options (including ride shares, buses, subways, taxis and more)

1x

Scene+ point for every $1 spent on all other eligible everyday purchases

Scene+ points¹ on every $1 you spend at Sobeys, Safeway, IGA, Foodland and participating Co-ops and more

3x

Scene+ points¹ for every $1 you spend on other eligible grocery stores, dining, eligible entertainment purchases and eligible daily transit options (including ride shares, buses, subways, taxis and more)

2x

Scene+ point for every $1 spent on all other eligible everyday purchases

1x

20.99%

Purchase APR

22.99%

Balance Transfer Rate

22.99%

Cash Advance APR

$150

Annual Fee

0.00%

Foreign Transaction Fee

Purchase APR

20.99%

Balance Transfer Rate

22.99%

Cash Advance APR

22.99%

Annual Fee

$150

Foreign Transaction Fee

0.00%

One savvy strategy to avoid paying these charges is to get one of the best no foreign transaction fee credit cards. We’re big fans of the Scotiabank Passport® Visa Infinite* Card, as cardholders are not charged a Foreign Currency Conversion mark-up on foreign currency purchases, whether you make them online or outside of Canada. Only the exchange rate applies.

Conditions Apply. Visit here for the Scotiabank Passport® Visa Infinite* Card to learn more.

*See Card Provider's website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

READ MORE: The best no foreign fee credit cards.

Cash advance fees

The best way to avoid paying cash advance fees altogether is to have savings set aside that can be accessed in an emergency. But for those times when it is an emergency, it’s wise to understand how cash advance fees work before you hit up the ATM. As a rule, cash advances are charged at a higher interest rate than usual purchases – around 22% and upwards. And unlike a regular purchase, cash advances don’t have a grace period, meaning you’ll be charged interest from the day you withdraw the money. You may also be charged ATM fees on top of other credit card fees.

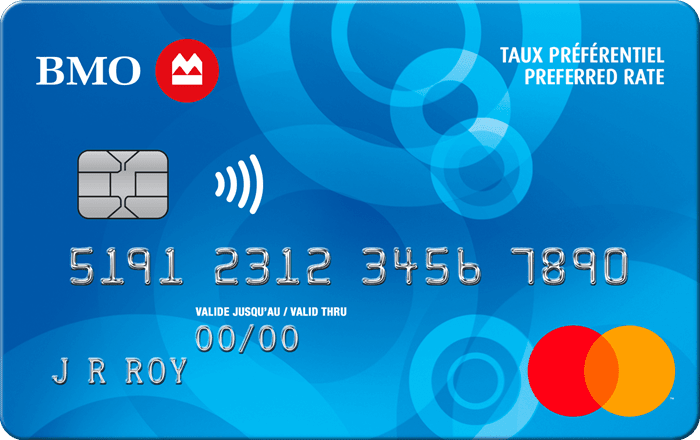

BMO Preferred Rate Mastercard®*

3.6

0.99% rate

Welcome offerGood

Suggested credit scoreGet a 0.99% introductory interest rate on Balance Transfers for 9 months with a 2% transfer fee and BMO will waive the $29 annual fee in your first anniversary*.

Expires

Nov 30, 2024

Pros

-

Low-interest rate: Offers a competitive purchase interest rate

-

Introductory balance transfer offer for the first nine months

-

First-year annual fee waiver

-

BMO PaySmart™ Installment plans: Turn new credit card purchases into small, interest-free monthly payments with a small fee.

-

Additional cardholder: You can add an additional cardholder for free

-

Free extended warranty and purchase protection*

-

Zero Dollar Liability: protects you from unauthorized use of your credit card*

Cons

-

No rewards: Your focus is paying down debt, not collecting miles.

-

Foreign transaction fee: Charges a 2.5% fee on foreign transactions.

-

Balance transfer fee: While normal, it’s a bit painful to have to fork over a 2% fee on balance transfers.

Eligibility

Good

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$0

Required Annual Household Income

$0

0.99%

0.99% introductory interest rate on balance transfers for 9 months with a 2% transfer fee and BMO will waive the annual fee on your first anniversary.*

0.99% introductory interest rate on balance transfers for 9 months with a 2% transfer fee and BMO will waive the annual fee on your first anniversary.*

0.99%

13.99%

Purchase APR

15.99%

Balance Transfer Rate

15.99%

Cash Advance APR

$29

Annual Fee

Purchase APR

13.99%

Balance Transfer Rate

15.99%

Cash Advance APR

15.99%

Annual Fee

$29

Pros

-

Low-interest rate: Offers a competitive purchase interest rate

-

Introductory balance transfer offer for the first nine months

-

First-year annual fee waiver

-

BMO PaySmart™ Installment plans: Turn new credit card purchases into small, interest-free monthly payments with a small fee.

-

Additional cardholder: You can add an additional cardholder for free

-

Free extended warranty and purchase protection*

-

Zero Dollar Liability: protects you from unauthorized use of your credit card*

Cons

-

No rewards: Your focus is paying down debt, not collecting miles.

-

Foreign transaction fee: Charges a 2.5% fee on foreign transactions.

-

Balance transfer fee: While normal, it’s a bit painful to have to fork over a 2% fee on balance transfers.

Eligibility

Good

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$0

Required Annual Household Income

$0

0.99%

0.99% introductory interest rate on balance transfers for 9 months with a 2% transfer fee and BMO will waive the annual fee on your first anniversary.*

0.99% introductory interest rate on balance transfers for 9 months with a 2% transfer fee and BMO will waive the annual fee on your first anniversary.*

0.99%

13.99%

Purchase APR

15.99%

Balance Transfer Rate

15.99%

Cash Advance APR

$29

Annual Fee

Purchase APR

13.99%

Balance Transfer Rate

15.99%

Cash Advance APR

15.99%

Annual Fee

$29

However, it is possible to find a credit card that won’t ding you so hard with high-interest rates on cash advances. For instance, the BMO Preferred Rate Mastercard®* offers a rate of 15.99% on cash advances. The APR on purchases is 13.99% and BMO covers theft and damage protection for items bought with the card*. Add to that, the BMO Preferred Rate Mastercard®* comes with a low annual fee of $29 (which is waived in the first year).*

*Terms and conditions apply.

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

Interest rate fees

One strategy for tackling credit card debt and avoiding sky-high credit card interest rate charges is through a balance transfer promotional interest rate. Essentially, it involves paying off one credit card with another, by transferring your current debt from a higher-interest card to a credit card with a significantly lower interest rate.

Typically, a balance transfer credit card offers an extremely low or even 0% interest rate, which means you’ll save money on interest charges.

Late payment fees

Even if you’ve got the best intention to settle your balance in full every month, it pays to understand how late payments lead to added credit card fees. Canadian credit cards offer a minimum interest-free grace period of at least 21 days after the billing period. However, if you fail to pay in full by the due date, you’ll be charged interest.

All Canadian credit cards charge interest on unpaid balances, but you may be able to escape a penalty for a tardy payment. For instance, some Canadian banks may not impose a late payment “fee” on their credit cards, but you’ll still rack up interest on the outstanding balance. However, making late or missing payments could cost you in other ways: some institutions may automatically hike the APR (Annual Percentage Rate) if you make two late payments in a 12-month period. Make a habit of it and late payments could damage your credit score.

The bottom line? Missed or late payments on your credit card are never a good idea. Avoid this sticky situation by setting up pre-authorized payments from your chequing or savings account on (or ideally, before) your payment due date.

Amanda Lee has been a freelance lifestyle writer for 10 years. She is the former Managing Editor of Toronto.com, which is owned by the Toronto Star. Her bylines have appeared in major Canadian publications, including the Toronto Star, WestJet Magazine and Today's Parent. Amanda is enrolled in an MFA in Creative Nonfiction at King's College and working on her first book.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.