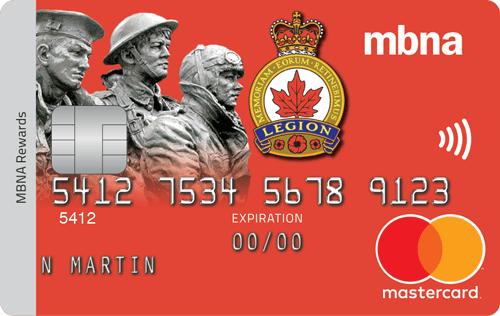

Quick overview of the Royal Canadian Legion MBNA Rewards Mastercard®

The Royal Canadian Legion MBNA Rewards Mastercard is a rewards credit card that has no annual fee and a welcome bonus of up to 5,000 MBNA Rewards Points. It'll appeal to those who frequently spend on restaurant, grocery, digital media, membership and household utility purchases, offering 2 points per $1 spent in these categories up to $10,000 annually. Other purchases earn 1 point per dollar. The card also includes birthday bonus points, flexible rewards redemption options and the MBNA Payment Plan for large purchases.

Another great feature with the card is that spending on eligible purchases helps support the care of Canadian veterans and their families.

However, the card's purchase APR (19.99%) and the cash advance APR is (24.99%) are on the high end, which will be off putting for those who regularly carry a balance.

Who is the Royal Canadian Legion MBNA Rewards Mastercard® for?

This card is ideal for individuals who value rewards for everyday spending, especially in categories like groceries and dining out, without having to pay an annual fee. It's geared toward people who appreciate flexible reward options and are comfortable with standard APR rates.

Pros and cons

Pros

-

No annual fee

-

Offers a welcome bonus of up to 5,000 points

-

Earn up to 2 points for every $1 spent on eligible purchases

-

Earn up to 2 points for every $1 spent on eligible purchases; points never expire as long as the account is open

-

Flexible rewards redemption options for things like travel, gift cards, merchandise, and more

-

Additional card benefits include purchase assurance, extended warranty coverage, car rental discounts, and more

-

A unique Birthday Bonus: Earn 10% of the total points earned the year prior, up to a maximum of 10,000 points.

-

Travel and security perks like lost luggage assistance, ticket replacement services and security features

Cons

-

High interest rates

-

No introductory balance transfer rate

-

Cap on higher earn rate categories

MBNA Royal Canadian Legion Rewards Mastercard welcome bonus

MBNA Royal Canadian Legion Rewards Mastercard offers a generous welcome bonus to new cardholders. By making your first eligible purchase within 90 days of opening your account, you can earn an impressive 2,500 bonus points. But that's not all! If you enroll in e-statements within the first 90 days, you'll receive an additional 2,500 bonus points. This means that you can earn a total of 5,000 MBNA Rewards Points as a welcome bonus. Don't miss out on this fantastic opportunity to boost your rewards!

How to earn points with the Royal Canadian Legion Rewards Mastercard® from MBNA

The card has different earn rates depending on where you shop:

- Earn 2 points for every $1 spent on eligible restaurant, grocery, digital media, membership and household utility purchases, up to $10,000 annually.

- 1 point for every $1 spent on all other eligible purchases

There is no maximum limit on points earned on general purchases.

MBNA Rewards points can be redeemed for various options, including cash back, travel rewards, gift cards, and merchandise. When redeeming points for travel, 100 points equal $1. However, the rate is lower when redeeming points for cash back, at 200 points, equaling $1. This may discourage those who prefer cash back, but getting a designated cash back card is recommended in such cases.

Key Benefits of the MBNA Royal Canadian Legion Rewards credit card

The key benefits of the MBNA Royal Canadian Legion Rewards credit card include its not having an annual fee, making it a cost-effective option for cardholders. Additionally, the card offers flexible rewards redemption options, allowing users to choose between cash back, merchandise, gift cards, and travel rewards.

Another advantage of this credit card is the birthday bonus points feature, which grants cardholders points equal to 10% of the total points earned in the previous year, with a maximum of 10,000 points. This bonus is a special perk for loyal customers, providing them with extra rewards on their birthdays.

MBNA Royal Canadian Legion Rewards credit card insurance coverage

- Mobile device insurance: Up to $1,000 coverage for eligible mobile devices in case of loss, theft, accidental damage, or mechanical breakdown.

- Purchase assurance: Coverage for eligible items purchased with the card if stolen or damaged within 90 days from the date of purchase, with a lifetime limit of $60,000 per account.

- Extended warranty: Doubles the manufacturer's warranty for up to one additional year on eligible new purchases.

Extra Benefits of the MBNA Royal Canadian Legion Rewards Mastercard

Other notable benefits of the MBNA Royal Canadian Legion Rewards credit card include:

- The MBNA Payment Plan can make it more convenient to pay for large purchases and manage your budget. Pay for eligible credit card purchases of $100 or over by making monthly payments.

- MBNA and Mastercard cardholder support

- Mastercard contactless payments

- Card verification codes (CVC) and chip & pin technology for an extra layer of security

How the MBNA Canadian Legion Rewards Mastercard® compares

MBNA Royal Canadian Legion Rewards Mastercard vs. Neo Credit Card

When considering the MBNA Royal Canadian Legion Rewards Mastercard and the Neo Credit Card, your choice should depend on your spending habits and reward preferences. The MBNA card offers a unique opportunity to support Canadian veterans while earning rewards. With no annual fee, it provides up to 5,000 bonus points and a rewards rate of 2 points per $1 on select categories, and 1 point per $1 on other purchases. Additionally, it offers Birthday Bonus points and flexible redemption options, including cash back and travel.

The Neo Credit Card, known for its high average cash back rates, might appeal more if you prioritize cash rewards. It offers an average of 5% cashback at thousands of partners and a minimum of 1% cashback overall, with no annual fee. However, the specific cash back rate can vary significantly based on where you shop.

MBNA Royal Canadian Legion Rewards Mastercard vs. SimplyCash Card from American Express

Comparing the MBNA Royal Canadian Legion Rewards Mastercard with the SimplyCash Card from American Express, the latter is appealing to those interested in straightforward cash back. The SimplyCash Card offers a flat cash back rate of 1.25% on all purchases, with no limit on the amount you can earn, and no annual fee. It also offers 2% cash back on eligible gas purchases in Canada, and 2% cash back on eligible grocery purchases in Canada (up to $300 cash back annually).

The MBNA card, while also having no annual fee, offers a more complex rewards system with the potential for higher rewards in specific categories and the added benefit of supporting veterans. Its reward structure is more beneficial if your spending aligns with its bonus categories.

MBNA Royal Canadian Legion Rewards Mastercard vs. Tangerine World Mastercard

When comparing the MBNA Royal Canadian Legion Rewards Mastercard to the Tangerine World Mastercard, the latter might be more appealing if you prefer customizable rewards. The Tangerine card allows you to choose two or three bonus categories (if you deposit your rewards into a Tangerine Savings account) where you earn 2% cash back, with 0.5% cash back on all other purchases. There's no annual fee, making it a flexible choice for rewards.

The MBNA card, offering support for veterans, also has no annual fee and provides a more diverse rewards program, including a unique birthday bonus. It's more suited for those who value supporting a cause while earning rewards in specific categories.

Is the MBNA Royal Canadian Legion Rewards Mastercard worth it?

The MBNA Royal Canadian Legion Rewards Mastercard is worth considering if you like the idea of having no yearly fees and earning rewards on everyday purchases, especially in its bonus categories. Its unique feature of supporting veterans adds a charitable aspect. However, high interest rates and lack of comprehensive benefits like travel insurance might be drawbacks for some. It's ideal for those who spend regularly in its reward categories and are interested in supporting a cause while earning points.

FAQs

Justin is a writer and editor who has been covering personal finance for over 10 years. He's written for companies such as KOHO, Ratehub, BMO, Zoocasa, and Questrade, among others. Justin also created a course in Content Creation, which he taught at York University for four years. When not writing, Justin can be found at a live concert, on the golf course, riding a motorcycle, or sailing.

Compare other MBNA credit cards

Compare other MBNA credit cards

Compare other rewards credit cards

Compare other rewards credit cards

Compare other no annual fee credit cards

Compare other no annual fee credit cards

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.