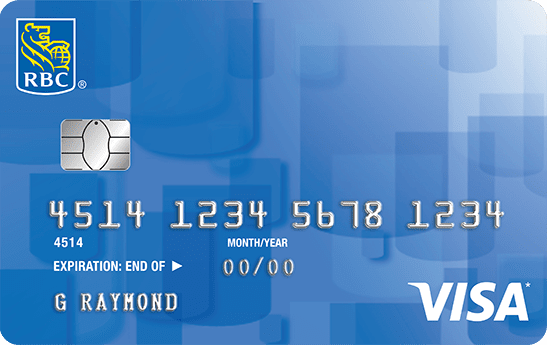

Quick Overview of the RBC Visa Classic Low Rate Option credit card

The RBC Visa Classic Low Rate Option offers relatively low interest rates while remaining accessible to customers who might not have a high annual income or credit score. The card's $20 annual fee is somewhat disappointing but for those who prefer a lower APR it might be more attractive than a travel credit card with an annual fee five times that amount.

Who can benefit from the RBC Visa Classic Low Rate credit card?

The RBC Visa Classic Low Rate credit card is ideal for anyone who wants a no-nonsense credit card that prioritizes a great low rate everyday, without the bells and whistles that come with a more expensive rewards credit card. Instead of rewards the card provides an exceptionally low APR that is, on average, 8-percentage points lower than other cards on the market, making it great if you are looking to finance a large purchase or pay down an existing credit card balance.

Pros and cons

Pros

-

Low interest rate

-

No minimum income requirement

-

Basic purchase protection and extended warranty

-

Linked benefits with Petro-Points program

-

Holistic evaluation for varied credit histories

Cons

-

$20 annual fee

-

Other cards offer similar rates with no annual fee

-

Optional benefits may be found cheaper elsewhere

-

Not among the best low-interest cards due to competition

-

Balance transfer promotions lacking compared to competitors

RBC Visa Classic Low Rate credit card welcome bonus

The card does not currently offer a welcome bonus.

How to earn rewards with the RBC Low Rate Visa

The RBC Low Rate Visa Classic card doesn't earn Avion rewards or cash back. Instead, it prioritizes a great low APR. That doesn't mean that there aren't any rewards with the card, however.

Cardholders can use their RBC credit card to earn additional Be Well points when linking the Low Rate Visa to their Rexall Be Well account. Cardholders earn 50 Be Well points for every $1 spent on eligible purchases at Rexall when they pay with your linked card and scan their Be Well card at checkout.

Interest rates with the Low Rate Visa from RBC

Instead of exposing a large purchase to standard Canadian credit card interest rates (usually around 20%) the RBC Visa Classic Low Rate Option charges about half of that in purchase interest: 12.99%. It also only charges 12.99% on cash advances. This makes the card ideal for those who are planning on charging a large purchase to credit and want flexibility in when they pay the balance off.

The purchase interest rate that RBC offers for the RBC Visa Classic Low Rate Option formerly correlated to an applicant’s credit score. But the RBC Visa Classic Low Rate Option now offers a fixed 12.99% rate, regardless of your credit score.

Key benefits of the Visa Classic Low Rate credit card from RBC

The primary benefit of a low-interest credit card like the RBC Visa Classic Low Rate is the potential for significant cost savings. With a lower interest rate, you can reduce the amount of interest you might accrue on outstanding balances or new, financed purchases. This can translate to substantial savings over time, especially if you typically carry a balance from month to month.

Having a credit card with a low interest rate also provides you with greater flexibility in managing their finances. This means you have the flexibility to make necessary purchases or handle unexpected expenses without incurring exorbitant interest charges, providing peace of mind and financial security.

RBC Visa Classic Low Rate Option insurance coverage

The RBC Visa Classic Low Rate Option card provides essential insurance protections:

- Purchase protection

- Extended warranty

Alongside the low interest rates, cardholders will enjoy basic purchase protection. When using the card to pay for new items, these purchases will benefit from coverage against direct loss or physical damage. If the items come with a manufacturer’s warranty, the RBC Visa Classic Low Rate Option can extend the warranty by up to one additional year.

Extra benefits of the RBC Low Rate Visa Classic credit card

While the card is decidedly bare bones, that doesn't mean it lacks some nice perks and surprises:

- Automatic savings on fuel at Petro-Canada: Link your RBC credit card and save $0.03 per litre on fuel⁴—and earn 20% more points in both loyalty programs (20% more Petro-Points and 20% more Avion points)⁵.

- Rexall points: As mentioned, cardholders earn 50 Be Well Points for every $1 spent on eligible purchases at Rexall Pharmacies across Canada by linking your card to your Rexall account.

- DoorDash savings: By adding your eligible RBC card to your DoorDash account, you can enjoy a 3-month complimentary DashPass subscription. With DashPass, you can benefit from unlimited deliveries with $0 delivery fees on orders of $15 or more when you pay using your eligible RBC credit card.

How does the RBC Visa Classic low rate option compare ?

If you might carry a credit card balance from month to month, it’s generally worth paying a small annual fee in exchange for a low interest rate, as your savings in interest payments over time can exceed the annual fee itself. But there are other Canadian credit cards that offer interest rates equal to or lower than the RBC Visa Classic Low Rate Option, and with comparable or lower annual fees.

Why pay an annual fee for a low interest rate if you don’t have to? The MBNA True Line® Mastercard® offers a similar 12.99% purchase interest rate as the RBC Visa Classic Low Rate Option, without the RBC card’s $20 annual fee.

Aside from its main competitive advantage of offering a low purchase interest rate for no annual fee, the MBNA True Line® Mastercard® also stands out because of its balance transfer promotion: Balance transfers✪ completed within the first 90 days of opening a new account have a 0% promotional interest rate† for a full 12 months. Those who take advantage of this offer must pay a 3% balance transfer fee (minimum $7.50).

Click here to apply or learn more by reading our complete MBNA True Line Mastercard® review.

Is the RBC Visa Classic Low Rate Card worth it?

Cardholders who might not pay off their balance and let it ride from month to month are exposed to interest charges that add up over time. In these circumstances it’s preferable to charge purchases to low-interest credit cards, which will minimize compounding balances as much as possible.

For example, if you’re carrying a balance of $1,000 with a credit card that has a standard 20.00% purchase interest rate, then you’d rack up $100 in interest in just 6 months. With this card’s interest rate of 12.99%, your compounded interest will be around $65 over 6 months—a savings of $35.

But the RBC Visa Classic Low Rate Card does not make the cut on our list of the best low-interest credit cards in Canada, because there are other cards out there with equally low or lower interest rates, and/or no annual fee. It’s safe to assume that savings in interest will outweigh the RBC Visa Classic Low Rate Card’s annual fee of $20. But you might save even more by instead going with one of the low-interest cards mentioned above.

Eligibility requirements for the RBC Visa Classic Low Rate credit card

A final benefit to consider is that RBC does not require a minimum annual income to be eligible for this card. RBC claims to be more holistic than the average bank in its evaluation of card applicants. Instead of relying solely on a credit score or report, RBC also takes into account an applicant's savings and debt-to-income ratio. This approach potentially opens the card up to applicants with varied credit histories.

Nonetheless, we generally recommend that you check your credit score before applying. Ensuring that you have a score around 650 or so will substantially increase your chances of approval.

†, ✪, Terms and Conditions apply.

This offer is not available for residents of Quebec.

Sponsored advertising. MBNA is a division of The Toronto-Dominion Bank (TD) and TD is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete information on this MBNA credit card, please click on the “Apply Now” button

The Toronto-Dominion Bank is the issuer of this credit card. MBNA is a division of The Toronto-Dominion Bank. ®MBNA and other-trademarks are the property of The Toronto-Dominion Bank.

Refer to RBC Page for up to date offer terms and conditions.

Cory Santos is a finance writer, editor and credit card expert with over seven years of experience in personal finance. Cory joined Wise Publishing from BestCards, with bylines in numerous print and digital publications across North America, including the Miami Herald, St. Louis Post-Dispatch, AOL, MSN and Medium as well as financial podcasts like KOFE Talk.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.