Farmland

It’s no secret that the ultra-wealthy love farms.

Bill Gates — the fourth richest person in the world with a net worth of $136 billion — is the largest private farmland owner in the U.S.

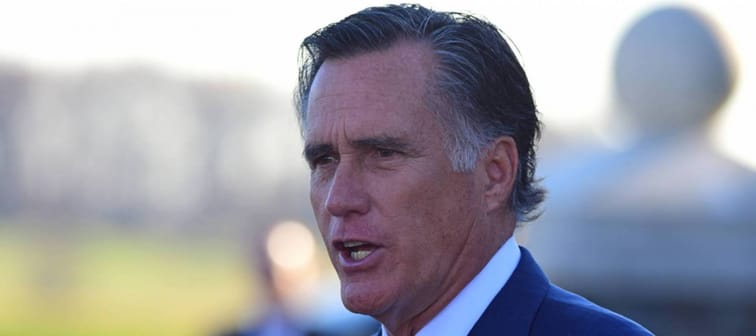

And Romney expects more fat-cats to plow into the space.

“These multibillionaires are gonna look and say, ‘I don’t want to invest in the stock market, because as that goes up, I gotta get taxed,” Romney said.

“So maybe I will instead invest in a ranch or in paintings or things that don’t build jobs and create a stronger economy.”

It’s easy to see the appeal of farmland: It is intrinsically valuable and has little correlation with the ups and downs of the stock market.

And even in a hyperinflationary environment, people still need to eat.

Between 1992 and 2020, farmland returned an average of 11 per cent per year. Over the same time frame, the S&P 500 returned only 8 per cent.

These days, you don’t need to be a multibillionaire to get a piece of the action. Investors can gain exposure to farmland through publicly traded real estate investment trusts like Farmland Partners and Gladstone Land Corporation, or by using an ETF like iShares MSCI Global Agriculture Producers ETF or the VanEck Agribusiness ETF.

A better online investing experience

Easy to use and powerful, Qtrade's online trading platform puts you in full control with tools and resources that help you make well-informed decisions.

Invest NowArtwork

Romney also mentioned paintings, which might be a little tough to understand.

Companies make profits. Farmland produces crops. But what can fine art deliver?

Well, it provides the one thing that matters most to investors: market-thumping returns.

Contemporary artwork has already outperformed the S&P 500 by a commanding 174 per cent over the past 25 years, according to the Citi Global Art Market chart.

Artwork has become an increasingly popular way for investors to diversify because it's a "real" physical asset with very little correlation to the stock market — much like precious metals and real estate.

In fact, the correlation factor between contemporary art and the S&P 500 was just 0.01 over the past 25 years. In other words, art zigs when stocks zag.

Earlier this year, Bank of America’s investment chief Michael Harnett even singled out artwork as a sharp way to outperform over the next decade — due largely to the asset’s track record as an inflation hedge.

Investing in art by the likes of Banksy and Andy Warhol used to be an option only for the ultra-rich, like Romney. But with a new investing platform, you can invest in iconic artworks, too, just like Jeff Bezos and Bill Gates do.

The bottom line

Whether you agree with Romney or not on farmland and artwork, inflation is happening.

The prices of numerous goods and services have gone up a lot over the past year. Meanwhile, the labor shortage could make things even worse.

For savers, it could lead to the serious deterioration of purchasing power.

So invest wisely.

Sponsored

Trade Smarter, Today

Build your own investment portfolio with the CIBC Investor's Edge online and mobile trading platform and enjoy low commissions. Get up to $100 in commission-free options until October 31, 2024.