What is the credit score range Canada uses?

Canada operates with a credit score range between 300 and 900. The lower your score, the less likely you are to be approved for a credit card or loan. If you do manage to qualify for a credit card or loan despite a low score, the interest rate you receive will likely be high.

Conversely, the higher your credit score, the more likely you are to be approved for a credit card or loan, and the lower the interest rate will likely be. Good credit can also help you rent an apartment, get a better job, get approved for insurance coverage at a lower premium and get a better plan for your cable, phone or utilities.

- Please Note: credit score ranges are taken from the Equifax scoring model. Ranges are subjective and can vary by credit bureau and credit issuer.

Excellent (800-850)

Consumers with excellent credit will likely have no or very few late payments in their credit report, will regularly pay off their balances in full, and will have a low credit utilization across all their lines of credit. Those with excellent credit enjoy rapid approval for their credit card and loan applications, as well as the lowest interest rates available, high credit and loan limits, and access to premium credit card benefits. In other words, all the financial doors are open to Canadians with excellent credit scores and banks roll out the red carpet to get their business. The median credit score in Canada is 749, which means 50% of the population has excellent credit.

Very Good (740-799)

This credit score level reflects borrowers who are financially responsible: Canadians who sit in this credit score range rarely make late payments and their credit utilization is likely low. Those with good credit scores are typically rewarded with low interest rates on loans, and are likely to qualify for most of the upper-tier cashback and rewards cards available, with perhaps the exception of some premium cards, which may require scores in the excellent strata.

Good (670-739)

Those on the mid to lower end of the average range have probably made multiple late payments to more than one lender and may have defaulted on a loan at some point. This kind of an uneven credit history means you will likely be offered relatively high interest rates from lenders, though an average credit score will at least qualify you for some worthwhile unsecured credit cards.

Fair (580-669)

Borrowers with below average credit will face higher interest rates for the lines of credit they are approved for, which can cost quite a bit of money over time. They also are not eligible for the more lucrative credit cards that provide accelerated levels of cash back and rewards.

Poor (300-579)

Borrowers in this credit score range may have defaulted on multiple loans, have combined debt very close to their overall credit limit (a high credit utilization ratio), or may have declared bankruptcy, which stays on your credit report for at least seven years. In this credit score range you will have a difficult time obtaining standard credit cards or loans, though you can improve your credit score by responsibly repaying credit extended to you via a secured credit card or a special loan for those with bad credit.

What is a credit report?

While a credit score is a simple shorthand for your creditworthiness, a credit report is a more complete overview of your financial history, and it’s one of the major tools a lender uses in determining whether or not to give you credit. Contained within your credit report is key identifying information like your address and social insurance number, your payment history with your creditors, a record of bankruptcies or any court judgments that would affect credit worthiness, a list of lenders or other parties that were authorized to look into your credit, and any banking or collections information.

Canadians are entitled to one free credit report per year (called a Consumer Disclosure) from either Equifax or TransUnion. Click here to apply for your free credit report from Equifax by mail, and click here to receive your free credit report from TransUnion either by mail or online. If you can’t wait a year for your free report from the credit bureau, Borrowell, a Canadian financial technology company and credit monitoring service, can give you free access to your credit score any time. I reached out to Borrowell’s CEO, Andrew Graham, to get his thoughts on the value of this new offering.

“Borrowell has recently launched free credit report monitoring. For the first time, Canadians are able to monitor important information in their Equifax credit report on a monthly basis for free online,” said Graham.

“Now more than ever, Canadians should keep a close eye on their credit and personal finances. We were proud to be the first company in Canada to offer consumers free access to their credit scores. This is a logical next step for us and gives our users a much deeper look into their overall credit profile, the same data used by many lenders, banks, cell phone providers and landlords.”

If you receive your credit report and discover any inaccuracies, inconsistencies, incomplete information or signs of fraud, you can dispute the information with the credit bureau.

What is a credit rating?

A credit rating is a rating listed by some credit reporting agencies. It is an individual rating of each of your credit history’s items detailing the type of credit being used and how quickly payments are made. The ratings for each item on your credit history are expressed on a scale of 1-9: “1” means you paid your bill within 30 days of its due date and “9” means you never paid your bill or that you’ve made a debt repayment proposal with the lender.

Along with the number, you will see a letter assigned to each credit rating. The letter stands for the type of credit being used. There’s “I” for instalment (e.g. a car loan), “O” for Open (e.g. a student loan) and R for revolving (e.g. a credit card).

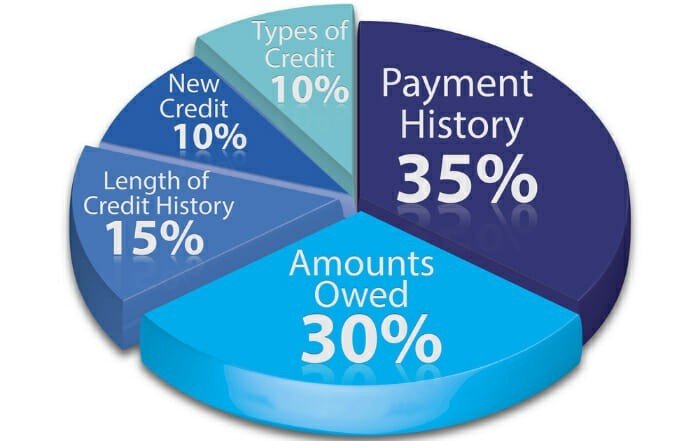

What factors influence a credit score the most?

There are many factors that influence a credit score positively or negatively. Equifax and TransUnion both have slightly different formulas for determining scores, but there are a few shared considerations evaluated above all else:

Payment history – 35%

Payment history is the most important factor influencing your credit score. Lenders want to see how likely you are to pay back the credit they are about to give you, and they figure it out by looking at how/whether or not you paid back your other loans and consumer credit.

Your payment history shows all of your consumer debt except for mortgages. It details whether you’ve paid each debt as agreed, whether payments have been deferred, whether the debt has been paid off entirely, whether payments have been late or whether you have any payments in collections. Bankruptcy filing and liens against you also fall into this category.

While the exact number of points that your credit score drops for each of the above infractions is shrouded in secrecy, a general rule is that the higher your credit score is to begin with, the more points you will lose for poor payment incidents. However, if your credit score is already low, you won’t lose as many points from new negative behaviors. For example, if your credit score is 780 and you have your first 30-day late payment, your score can drop 90-110 points (more if it’s over 30 days late). However, if your credit score is 680 and this is your third late payment, your score will only drop 60-80 points. Similarly, a foreclosure means a credit score falls 140-160 points if your original credit score was 780, but falls only 85-105 if your original credit score was 680.

More recent payment history has a greater impact on your score, and more distant payment history has a lesser impact.

Credit utilization – 30%

Credit utilization refers to the amount of credit that you are using relative to the amount that is allotted to you. For instance, if you have a credit card with a $1000 credit limit, and you have a balance of $200 on that card, it’s a 20% credit utilization.

A widely-regarded rule of thumb is to keep your total credit utilization across all credit products lower than 30%.

Length of credit history – 15%

Creditors like to see that you’ve had credit history for a long time, and that you’ve used credit consistently. Those who have short credit history, or who haven’t regularly used the credit they were allotted, are seen as being at greater risk of defaulting on their balances.

Soft and hard credit checks – 10%

A ‘soft check’ occurs when you check your credit score, or when anyone else reviews your credit history for non-lending purposes. It does not negatively affect your credit score.

A ‘hard check’, on the other hand, occurs every time you apply for a credit card or loan. Having too many hard checks in your credit history during a short period of time can negatively affect your credit score (knocking it 7-10 points). A large number of applications for credit products can signal financial difficulty to your creditors and make them suspect you of “credit shopping.”

Diversity of credit – 10%

Diversity of credit shows lenders how many types of credit products you have in your credit history. The more diverse your credit history – showing a variety of responsibly-used credit types like loans, credit cards and lines of credit – the better. Credit diversity with payments made on time shows lenders you’re responsible with all types of credit, which makes them more apt to lend to you.

Total payment ratio

Though not officially part of credit score calculations yet, credit bureaus are now beginning to look at a new factor called a Total Payment Ratio (TPR). TPR has been a consideration on TransUnion’s credit reports since 2015. Do you generally pay the minimum? Do you generally pay significantly above the minimum? Or do you typically pay off your balance in full? These are the questions that your TPR answers: how much do you pay and how consistently do you pay it?

While TPR shows up on TransUnion’s credit reports, the Globe and Mail has reported that neither credit bureau is as of yet factoring in TPR when calculating credit actual credit scores. This may change in the future.

How to increase your credit score

Negative information can stay on your credit report for at least seven years. If you have negative factors in your history you need to counter them with positive steps toward repairing your score. And there’s no time like the present, right? We advise you to start by focusing on these key steps:

Pay your bills consistently and on time

Pay your bills each month by the due date. Late payments can really bring down your credit score, so set up automatic payments to never miss your deadline. If you pay with online banking, make sure you pay a few days in advance of the deadline to ensure the payment is processed in time.

Reduce your credit utilization

Try to pay off your credit card balances and other debts so you are only using a portion of the credit you have available: 75% is a start, 50% is better and 30% and below is best. It should take about a month for your credit score to rebound (reportedly between 40-80 points) after reducing your utilization to below 30% and keeping it that way, provided there aren’t any more strikes against you (like late payments).

Resist credit inquiries unless absolutely necessary

Make sure credit inquiries aren’t being made on your credit report on a regular basis. Soft credit checks—those in which you or a prospective landlord or employer look at your score—don’t affect your credit score. But hard credit checks, like when you want to increase a credit limit or apply for a credit product or loan, always do. You can learn more about the difference between the two inquiries by reading our in-depth article on the effect of checking your credit score.

Some Canadians rack up cash back and rewards points by engaging in “credit churn,” a practice where applicants apply for credit cards to take advantage of sign-up bonuses offered in the first few months and then cancel these cards when the bonus period expires. But this practice is unkind to your credit score, as each time you apply for a new card it can take up to ten points off.

Correct misinformation and update old information

Take advantage of the annual free credit report application and get your copy. Not only will it tell you whether your credit score is low or high, but it will let you know if there are any open credit lines that shouldn’t be there (perhaps indicating fraud) and if there is any negative information there that’s older than seven years that simply hasn’t been removed. According to Borrowell, there’s also a statistical correlation between regularly monitoring your credit report and improving your score.

“A recent study we conducted found a positive relationship between the frequency of credit score monitoring and credit score increase over time. Drawing from user data, we found that customers with lower initial scores at sign-up tended to improve their scores the most – by as much as 30 points among engaged users. In short, Borrowell users that monitor their scores more frequently see the largest increase in their scores,” says Borrowell CEO Andrew Graham.

Once you review your credit report, work to get misinformation removed if anything is in collections: work to pay off the amount owed and ensure that the collections agency will remove that from your credit report as soon as they receive the owed amount. Get the agency’s guarantee in writing, and then check your credit report at a later date to make sure it reflects the hard work you’ve put in to clean it up. Only what is true should remain.

Do not close paid-off credit cards right away

When you do pay off your debt, resist the urge to close your credit accounts right away, because keeping paid-off credit products open can keep your credit utilization low.

Think of it this way: Let’s say you have two credit cards, each with a $1,000 credit limit. One has a balance of $500, and the other a balance of $0. This means you are using $500 out of $2000 in credit, which works out to a strong 25% utilization. But the moment you close your $1,000 credit card with the $0 balance, suddenly you’re down to a $500 balance on the remaining $1,000 card, which doubles your utilization to 50%. Before closing the paid-off credit card you were well below the recommended credit utilization ratio of 30%, but after closing it you jumped above it.

Build credit by exiting consumer proposal

If you’ve had overwhelming credit issues, negotiating a consumer proposal can help you get out of debt while only paying back a portion of your overall debt. This process is expensive and will severely lower your credit score. You can remain in consumer proposal for a maximum of five years, but you can exit it early and start rebuilding your credit score sooner by applying for a consumer proposal loan. This loan will pay off your creditors and allow you to exit consumer proposal, and you’ll begin rebuilding your credit score as you make regular payments on the loan.

Get help with some tools

In this digital age, we are lucky to have some great solutions to our most pressing problems, including our credit score. Tools like KOHO’s Credit Builder, which costs between $7-$10 a month for 6 months, and offers an interesting approach to reporting payments to credit bureaus on your behalf, and MyMarble by Marble Financial which offers a comprehensive suite of solutions and educational resources to provide you with a more long term plan, can help put you in the right direction.

Don’t be afraid of a fresh start

Consult a credit counsellor before engaging in bankruptcy proceedings—such a move can damage your credit for seven years and very few creditors will lend to you during that time. However, if you do take this drastic step, know that you can rebuild your credit with a secured card. This is a credit card requiring an upfront deposit that makes up your credit balance, but still gets reported to credit bureaus to help you re-establish your credit and eventually go back to an unsecured card.