-1693491799.png)

Wealthsimple review

fizkes / Shutterstock

Updated: June 28, 2024

Credibility5

On-boarding process5

Large accounts5

Fees5

Re-investment policy5

Customer service5

- Access to human advisors

- Sleek, user-friendly platform

- The ETF MERs are nearly the lowest in the industry

- Automatic tax-loss harvesting for Premium & Generation clients

- Broad investment selection, including Halal and SRI funds

- Tons of industry experience

Promo Offer: Get $25 bonus when you open and fund your first Wealthsimple self-directed investing account with at least a $500 initial deposit. Trade and Cash accounts are not eligible. Sign up now to take advantage of this exclusive offer!

Wealthsimple robo-advisor

Wealthsimple is one of the world’s leading robo-advisors, with offices in Canada, the USA, and Europe. The company was founded by CEO Michael Katchen in 2014, whose goal was to “bring smarter financial services to everybody, regardless of age or net worth.” Before starting Wealthsimple, Katchen worked at a Silicon Valley start-up and dispensed DIY investing advice to his colleagues.

With headquarters in Toronto, Wealthsimple is well-equipped to manage your money. They employ a team of world-class financial experts and the best technology talent. Their software engineers, designers, and data scientists have previously worked at esteemed companies such as Amazon, Google, and Apple. Today, Wealthsimple has over 600 employees and more than $30 billion in assets under management and 3 million people using Wealthsimple world-wide, making them the largest robo-advisor in Canada.

In short: they know what they’re doing with your money and they have a legal fiduciary duty to their clients.

Wealthsimple features

There are many excellent reasons why Wealthsimple stands out as the best robo-advisor in Canada. All it takes is a scan of the exceptional features and services provided to their clients:

- Portfolio review service: Wealthsimple offers its customers a free portfolio review which encompasses an evaluation of your non-Wealthsimple financial accounts. They will analyze the fees, the tax efficiency of your account and the portfolio allocation of any third-party accounts you hold.

- Free tax-loss harvesting: This feature only concerns investors with taxable accounts but can be a useful tool if you are investing money outside of your RRSP or TFSA. Tax-loss harvesting lowers your taxes on investment gains by offsetting them with investment losses. Most robo-advisors and financial advisors offer this service to high-value customers, but all Wealthsimple clients have the option of using tax loss harvesting and it’s done automatically for Wealthsimple Premium and Generation clients.

- Access to financial advisors: Most robo-advisors are fairly hands-off when it comes to financial planning. This is one of the ways they manage to keep their fees so low. But if you’re a Wealthsimple Premium client, you have access to goal-based financial planning with an experienced portfolio manager. Likewise, Wealthsimple Generation clients have access to in-depth financial planning and a team of experts that will even design a personalized financial report customized to your goals. But regardless of tier, every Wealthsimple client has unlimited access to human experts providing financial advice.

- Investment in fractional shares: Like most robo-advisors, Wealthsimple builds your portfolio out of ETFs, and chooses an asset allocation based on your risk tolerance. By investing in fractional shares, every dollar you contribute (even if it’s a small deposit) is invested immediately, so you can start earning interest right away without having to wait until you have enough cash to purchase a full share. Basically, this means that a $10 portfolio can have the same diversification as a $1 million portfolio.

- Socially responsible investment options (SRIs): Their socially responsible investing option lets you build portfolios using proprietary low-free SRI ETFs that include the most socially responsible companies in North America and developed global markets, and eliminates the top 25% carbon-emitters in each industry. Every company in their funds has 25% or at least 3 women on their board of directors. A big bonus: Wealthsimple charges the same management fees for SRI portfolios as non-SRI portfolios.

- Pays your transfer fees: Transfer your account to Wealthsimple and they will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

- Other innovative products: Unlike traditional robo-advisors, Wealthsimple also has a slew of other offerings. For instance, there’s Managed investing (formerly Wealthsimple Trade)– which allows you to build a custom portfolio designed for long-term growth, Self-directed investing - offering low-fee, do-it yourself investing, and Wealthsimple Crypto - which allows you to trade and take coins. Additionally, supersavers will love Wealthsimple Cash – a high-interest savings account that has no introductory rate and offers an interest rate of up to 5%. Wealthsimple also offers Halal Investing – a new investment portfolio designed to comply with Islamic law and that’s guided by experts in both religion and finance.

- Tools to help you save money: Wealthsimple has all sorts of technological tricks to help you maximize your savings and investments. For example, you can use your Wealthsimple Cash Mastercard to put your 1% cash back from your chequing account into your RRSP, TFSA, or simply back to your Cash account.

Note: Wealthsimple has discontinued its Roundup and Overflow features in favour of this cash back option.

Wealthsimple Invest vs. Wealthsimple Trade: What's changed and what's the difference?

Wealthsimple's two main products used to be known as Wealthsimple Invest and Wealthsimple Trade (though they also offer other products like Wealthsimple Cash, Wealthsimple Tax, and Wealthsimple Crypto). Recently, Wealthsimple has brought these individual platforms under their main umbrella and are now found under the names Wealthsimple self-directed investing and Wealthsimple managed investing. While both Wealthsimple platforms are related to investing, they function very differently and serve distinct needs.

Services offered

Though the services offered by both Wealthsimple self-directed investing and Wealthsimple managed investing relate to investing, the forms of investing and platforms each one uses are radically different.

Wealthsimple managed investing

Wealthsimple managed investing is the company’s robo-investing wing and as such it only offers passive, automated investing. When you join, you fill out a questionnaire with information about your income, investment goals, investment time horizon, and risk tolerance. Based on the information you provide, Wealthsimple then automatically matches you to a portfolio from one of three categories: conservative, balanced, or growth. Each portfolio is comprised of low management fee ETFs. Wealthsimple then manages the portfolio for you, rebalancing it and buying and selling funds based on market conditions. You never have to lift a finger.

With Wealthsimple managed investing, all you’re required to do is periodically add more money (if you want to) or make withdrawals based on your needs. The role of the individual investor is as a passive investor and your interaction with your account is minimal. Even if you wanted to, you can’t buy or sell ETFs within your portfolio because all of the work is done for you. Though you don’t control your own portfolio, it’s notable that Wealthsimple does offer an impressive array of portfolios. On top of the conservative, balanced, or growth portfolios, they also have socially responsible investing options, as well as Halal portfolios.

Wealthsimple self-directed investing

Where Wealthsimple managed investing Invest takes a passive investing approach, Wealthsimple self-directed investing is 100% active investing. It’s an online-only, commission-free investing platform that gives would-be investors access to U.S. and Canada-listed stocks and ETFs. There’s nothing automatic about Wealthsimple self-directed investing. When you sign up there is no questionnaire to fill out because Wealthsimple isn’t generating an automatic, pre-built portfolio for you.

It’s up to you to pick what stocks and ETFs you want to buy. It’s also up to you to rebalance your own portfolio and do your own research about stocks. You can buy or sell as many funds as you want. Because Wealthsimple self-directed investing sticks with relatively low-risk ETFs, the risks with Wealthsimple managed investing are also potentially much greater, depending on what equities you buy.

Type of accounts

Wealthsimple managed investing

Wealthsimple managed investing offers a plethora of accounts, including personal accounts, RRSPs, TFSAs, RESPs, RRIFs, LIRAs and even corporate accounts. You can also open joint accounts. Additionally, be aware that all account types offered by Wealthsimple managed investing are covered by the Canadian Investor Protection Fund (CIPF), an insurance program that protects investors and their funds up to one million dollars if an investment firm goes bankrupt.

Wealthsimple self-directed investing

Wealthsimple self-directed investing offers fewer account types. With Wealthsimple self-directed investing you can hold your assets in a TFSA, RRSP, or a personal (not joint) investment account. Wealthsimple self-directed investing accounts are also protected by the Canadian Investor Protection Fund.

Ease of getting started

Wealthsimple managed investing

Robo-investing is a new concept for many people so Wealthsimple managed investing clearly makes it a priority to make sign-up as easy, quick, and pain-free as possible. You begin by clicking “Get Started” on the home page and then you’ll be asked some basic info like your name and email.

Next, you’ll go through a series of questions regarding your previous investment experience. Once you’ve been matched with a portfolio, you’ll then e-sign some investment management agreements. Finally, you’ll need to upload a bank statement, provide a screenshot of your bank account or a void cheque to confirm your banking information.

On average your account will be ready within 5 business days. The whole sign-up process takes under 10 minutes. Whether or not you have any experience with investing or online banking as a whole, the sign-up process for a Wealthsimple managed investment account is very user-friendly and unintimidating.

Wealthsimple self-directed investing

Starting up with Wealthsimple self-directed investing is even easier than with Wealthsimple managed investing because you don’t have to answer investment experience and goal questions. You’ll be in charge of your own investment portfolio. You begin by downloading the Wealthsimple app. If you don’t already have a Wealthsimple account, you will have to quickly set up an account by answering a few questions. After you set up an account you just need to connect your bank account so that you can deposit funds. That’s it. You can be trading in as little as 5 minutes (though it will take up to 5 days to get your bank accounts connected if you’re not already a Wealthsimple client).

Experience required to use

Wealthsimple managed investing

Setting up an account and monitoring how the account is doing is incredibly easy even for a complete newbie (whether that be a newbie to investing or digital financial services) thanks to the user-friendly website and the fact that you don’t have to set up your own portfolio.

Wealthsimple self-directed investing

Following the same streamlined and engaging website design as Wealthsimple managed investing, Wealthsimple self-directed investing is easy to join and buying and selling stocks is a straightforward process. You would certainly not need any experience with investing to start using Wealthsimple self-directed investing, however, if you are new to investing it can be very overwhelming to decide what stocks to buy and sell since there is little in-depth equity information on the site.

Intended user

Who should use Wealthsimple managed investing?

Wealthsimple managed investing is restricted to passive robo-investing and as such is ideal for new investors who are intimidated by investing and would rather take a hands-off approach and let someone else manage their portfolio. However, despite being ideal for new and inexperienced investors, Wealthsimple managed investing is also good for experienced investors who just don’t have the time or inclination to manage their own investments.

Though suitable for inexperienced investors, it is completely online with no brick-and-mortar offices. It would not be a good fit for a person who isn’t comfortable with an online-only interface and who needs and enjoys meeting with an investor face to face.

Who should use Wealthsimple self-directed investing?

While it’s certainly easy to set up an account to start investing, getting the most out of Wealthsimple self-directed investing does require some experience with investing. You have to be comfortable buying and selling stocks with no supervision and advice. Wealthsimple self-directed investing is a better match for investors who don’t need a lot of hand-holding and who feel comfortable and have the time to manage their own portfolios.

Despite not being necessarily an ideal fit for new investors, the fact that there are no commission fees does make Wealthsimple self-directed investing a good option for those who have at least a basic knowledge of the stock market and are ready to give interactive investing a try.

Plus, self-directed investing will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

Wealthsimple managed investing

When it was launched in 2019, Wealthsimple Trade made waves as Canada’s first commission-free trading platform. The platform has been through a few tweaks since its inception (the addition of a desktop-based version and a $3-a-month premium account option, for example) and today, lives under the refreshed title of managed investing, but overall remains a no-frills, user-friendly investing option.

If you’ve been considering checking out Wealthsimple managed investing but DIY trading gives you anxiety, we’ll show you how to use Wealthsimple managed investing in this comprehensive step-by-step guide.

How Wealthsimple managed investing works

Wealthsimple managed investing is for self-directed investors. It’s a platform that investors can use to buy and sell stocks and ETFs, similar to what’s offered by the best discount brokerages in Canada. All you have to do is download the app onto your phone or tablet or access the trading platform via your desktop computer.

Once you find a stock you’re interested in, you can add it to your watchlist feature. When you’re ready to buy, the stock is yours with just a couple of taps on your phone. Selling a stock is just as straightforward.

One thing to note: if there’s a hot stock that you might want to buy, make sure you have enough money in your trading account, as it can take up to three days to transfer money from your linked bank account to your Wealthsimple managed investing account.

Key Features

- Commission-free trading: It’s Canada’s first and only commission-free trading platform. You can buy and sell thousands of stocks and ETFs on major Canadian and U.S. exchanges.

- Includes crypto: With the Wealthsimple App, you can access Wealthsimple Crypto— Canada’s first and only regulated crypto trading platform. It offers 50+ coins and tokens for traders to choose from, including Bitcoin, Ethereum, Litecoin, and Dogecoin.

- Diverse accounts to fit your financial goals: Wealthsimple managed investing supports RRSP, TFSA, and non-registered accounts – with a promise of more account types available in the future.

- Seamless sign-up: Just download the Wealthsimple app and tap “Get Started.” Or sign up via desktop.

- No account minimums: Start trading with as little as $1.

- Mobile app: Trading has never been easier with the Wealthsimple app. Search and track stocks easily with your watchlist, and trade with just a few taps on your phone.

- Transfer fees covered: Plus, Wealthsimple managed investing will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

How to buy stock using Wealthsimple managed investing

Follow these steps and you’ll be off to the races.

Step 1: Log in to Wealthsimple managed investing

Open the Wealthsimple app or log into your Wealthsimple account via your desktop. (Note that the visuals may be slightly different depending on whether you’re trading via the app or the website — though overall the appearance is quite similar).

Make sure to pick “Trade & Crypto,” not “Invest and Save!” The latter will take you to the Wealthsimple robo- advisor.

If you don’t have an account, it only takes a few minutes to sign up. Plus, Wealthsimple managed investing will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

Step 2: Fund your account

If you don’t have any money in the account, you need to add funds before you can start trading.

Start by hitting “Add funds.”

Then enter the amount of money you want to deposit.

Then, wait for your deposit to arrive in your account. It usually takes about 30 seconds.

Depending on how much you deposit into your account, some funds might be available instantly, while the rest might take between 3–5 business days before you can begin trading. You can instantly deposit $1,500 with a free account, and $5,000 if you are a Plus subscriber ($10/month).

Once the money hits your account, you can start trading. You can also set up regular auto deposits so you’re never without funds.

Step 3: Search for stocks

Now the fun part: shopping for stocks!

In the app, hit the Browse Stocks button or use the search bar at the top right corner of your screen to search stocks and ETFs. You’ll be taken to a screen that features a list of stocks ranked by activity and performance.

You’ll also find other headings, including crypto (if you wanted to buy any crypto, you need to open a Wealthsimple Crypto account), biotechnology stocks, newly listed stocks and more.

Another option is to simply tap on the heading to get a more detailed list of stocks from the specified category.

For example, let’s say I want to buy one share of Air Canada stock. I could either hit Air Canada from the Top 100 screen or start typing the stock symbol or company name in the search bar.

Step 4: Read the stock chart

Next, you want to check out all the info about a stock or ETF.

Using Air Canada as the example again, I tap AC and then details about the stock are displayed. That includes information about:

- What exchange the stock is sold on

- The highest the stock has traded for in the last 52 weeks

- The market cap (the total number of outstanding shares multiplied by share price).

Note that there is a 15-minute delay for the data. You would need to get a premium Wealthsimple managed investing account to get to the second stock data.

Step 5: Select the stock

If you decide you want to buy the stock, you just hit “Buy.” You will then be asked how many units of the stock you want to buy. Select the amount and hit continue.

Note that the price of the stock and the cost to buy it are the same because Wealthsimple managed investing does not charge a fee. (However, if I had wanted to buy a U.S. stock, Wealthsimple managed investing charges a 1.5% currency conversion fee on Canadian to US dollar conversions.)

Step 6: Confirm the purchase

You’ll then be asked to confirm the purchase.

Your order will then be sent.

Step 7: Pour yourself a drink. You’re done!

You will get an email to confirm that your order has been filled.

How to sell stocks on Wealthsimple managed investing

Selling stocks on Wealthsimple managed investing is just as easy and intuitive as buying them.

Step 1: Select the stock you want to trade

Login to your account and go to the dashboard, where you can see what stocks you hold and how they’ve been doing. For this example, I only have this one share of Air Canada stock that I can sell.

Step 2: Tap the stock you want to trade

Go to the portfolio section, which is about halfway down your dashboard landing page. Just tap the stock symbol.

Step 3: Select “sell”

Once you tap the stock symbol (in this case, AC), Wealthsimple managed investing will take you to a new screen that asks you if you want to buy or sell the stock. Simply hit “sell."

Step 4: Select number of stocks to sell

Wealthsimple will show you the number of shares you have and how many are available for sale. They will also show you the sell price per share.

Step 5: Confirm the sale

Simply hit “Continue” once you’ve selected the number of stocks to sell.

You’ll then be asked to confirm the sale. You’ll also be shown how much it will cost you to make the trade. Of course, because Wealthsimple managed investing is commission-free, there is no charge to sell the stock.

Step 6: Order sent. You’re done!

That’s it! You have sold your first stock (hopefully not at a loss!).

Wealthsimple will also send you an email to confirm that your order has been filled. Best of all, if you’ve made a mistake and want to rebuy the stock, you can do so easily and without paying a trading fee.

Wealthsimple fees

When it comes to fees, this is where Wealthsimple really shines. They have straightforward pricing over three tiers:

Fees

- Core (First $99,999): 0.5%

- Premium (Above $100,000):0.4%

- Generation (Above $500,000): 0.4%

ETF MERs:

- Approximately 0.1 to 0.2% annually

- For SRIs: 0.25% to 0.4%

What’s also great: Wealthsimple’s ETF MERs are nearly the lowest in the industry: ranging between 0.10% to 0.20 %, for a total cost of 0.50% to 0.70% (when you factor in MERs with account management fees – depending on the funds you choose). SRI MERs are 0.25-0.40%, so clients pay 0.65% to 0.90% all-in. You’ll also find excellent savings account options and features like tax-loss harvesting and financial goal planning.

The lower fees of 0.4% for Wealthsimple Premium and Generation clients are also incredibly reasonable for the VIP services that you get. The lower fees, access to financial planning, tax-efficient features, and complimentary airline lounge pass make this worthwhile. Also, the tax-loss harvesting alone could save you money if you are investing outside of a TFSA or RRSP. Plus, who doesn’t love feeling like a VIP?

Pros and cons

When deciding if Wealthsimple is right for you, consider these pros and cons:

Pros

-

Tons of industry experience, with access to human advisors

-

ETF MERs: 0.1%- 0.2% (nearly lowest in the industry)

-

Reasonable fees (0.40% to 0.50%)

-

Broad investment selection, including Halal and Socially Responsible Funds

-

Automatic tax-loss harvesting for Wealthsimple Premium & Generation clients

Cons

-

Limited portfolio options

Different program tiers

As mentioned, Wealthsimple has three pricing tiers:

- Core (deposit up to $100,000) – 0.5% fee

- Premium (deposits of $100,000 to $500,000) – 0.4% fee

- Generation ($500,000+ in deposits) – 0.4% fee with a bunch of additional perks

Wealthsimple Core

Wealthsimple Core is where most investors will start. If your account balance is less than $100,000, you’ll be using Wealthsimple Core. With Wealthsimple Core, you get access to the important features that have made Wealthsimple popular, including:

- Management fee of 0.50%

- The ability to set up a wide array of account types like RRSPs, TFSAs, RESPs, and more

- Socially responsible investing options

- Halal investing options

- High-interest savings accounts

- Unique tools to help turbo-charge your savings like Roundup and Overflow

- Three different ETF-based portfolios to suit your situation: Standard, SRI, or Halal portfolios in risk levels 1 to 10

- Auto-rebalancing, auto deposits, dividend reinvesting, and expert financial advice

Wealthsimple Premium program

If you’re looking to invest $100,000 or more with Wealthsimple, you’ll qualify for Wealthsimple Premium. Note: your $100,000+ can be spread out across all of your Wealthsimple accounts and still qualify for Wealthsimple Premium. The Wealthsimple Premium program gives you access to premium services reserved for Wealthsimple’s high-value clients. Here’s what you’ll get when you’re a member of Wealthsimple Premium:

- Lower management fee of 0.40% (versus 0.50% for smaller accounts)

- Tax-loss harvesting

- Tax-efficient funds

- A financial planning session with one of Wealthsimple’s expert advisors

Wealthsimple Generation

If your combined family account size is larger than $500,000, you’ll qualify for Wealthsimple Generation. This tier takes your finances to the next level, giving you access to the perks of Wealthsimple Core & Wealthsimple Premium:

- In-depth financial planning

- Portfolios that are tailor-made for you

- A personalized financial report that includes income planning in retirement

- A team of dedicated advisors

- 50% off a comprehensive health plan from Medcan.

Wealthsimple investing model

Wealthsimple uses the Nobel Prize-winning Modern Portfolio Theory to design their portfolios. This theory gained fame in the 1950s when Harry Markowitz figured out that it was the best way to manage your money over the long term. The Modern Portfolio Theory determined that a passive investing approach to the market (that is, assembling a portfolio that minimizes volatility by diversifying) is a proven and reliable way to grow your money over a long period of time.

Wealthsimple puts this theory to work by designing portfolios that use low-cost ETFs to track the market as a whole. This strategy minimizes the risk to your money by eliminating the volatility of individual stocks and taking advantage of winners by investing in a lot of stocks at once – optimizing your investment returns.

Portfolio options

Wealthsimple has three primary portfolio options:

- Conservative: This portfolio is heavily weighted toward low-volatility bonds, with 62.5% of its holdings in government bonds, high-yield bonds, and short-term bonds. Designed for investors who prefer stability and a modest return. The conservative portfolio has a five-year annualized return of 5.34%.

- Balanced: This portfolio has a 50/50 ratio between bonds and equities. Suitable for investors with low-to-medium risk tolerance. The balanced portfolio has a five-year annualized return of 6.10%.

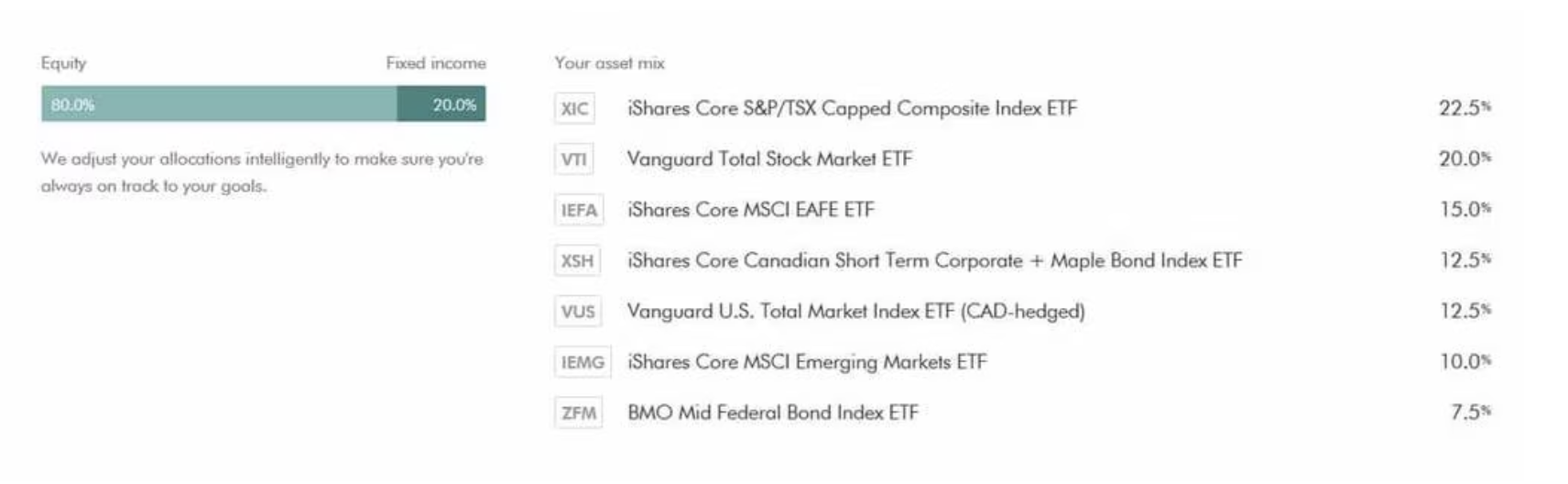

- Growth: This portfolio is strongly weighted towards stocks, with up to 80% of its holdings in emerging markets, foreign stocks, Canadian stocks, US stocks, International stocks, and Emerging Market stocks. Designed for an investor with medium-to-high risk tolerance. The growth portfolio has a five-year annualized return of 8.18%.

During sign-up, you’ll be asked to complete a questionnaire designed to match you with one of their three portfolios. These portfolios each have an asset allocation designed to suit your risk tolerance and time horizon and are built with ETFs. This lets Wealthsimple build a very diverse portfolio without the costs of constantly buying, selling, and re-balancing.

Asset classes

Each of the Wealthsimple portfolios includes nine ETFs, with each ETF representing a unique asset class. Here are the ETFs that Wealthsimple uses to construct your portfolio:

How does Wealthsimple compare to other advisors?

If you really want to get into the nitty-gritty, check out our review of the best robo-advisors in Canada. But here’s the short story: taking fees and features into consideration, Wealthsimple wins out above the competition, offering clients:

- Easy sign-up process: no visits to bank branches or endless document signing and scanning

- No account minimums: some robo-advisors require anywhere between $1,000, $5,000, or more for a minimum investment. Wealthsimple has no minimum investment requirements.

- Easy, automatic contributions: “set it and forget it”

- No account inactivity fees: some robo-advisors will charge $25 per quarter for unfunded accounts

- Three portfolio options: three options may not be enough to suit every financial situation, but some investors appreciate the simplicity.

- A mobile app that’s one of the best in the business.

- Innovative features to maximize your investments that are unique to the industry, including Wealthsimple managed investing, high-interest savings accounts, investing spare change (Overflow) and more.

- Competitive fees: Considering the services offered by Wealthsimple, their fees are highly competitive when compared to other leading robo-advisors in the industry.

User experience: A peek inside Wealthsimple

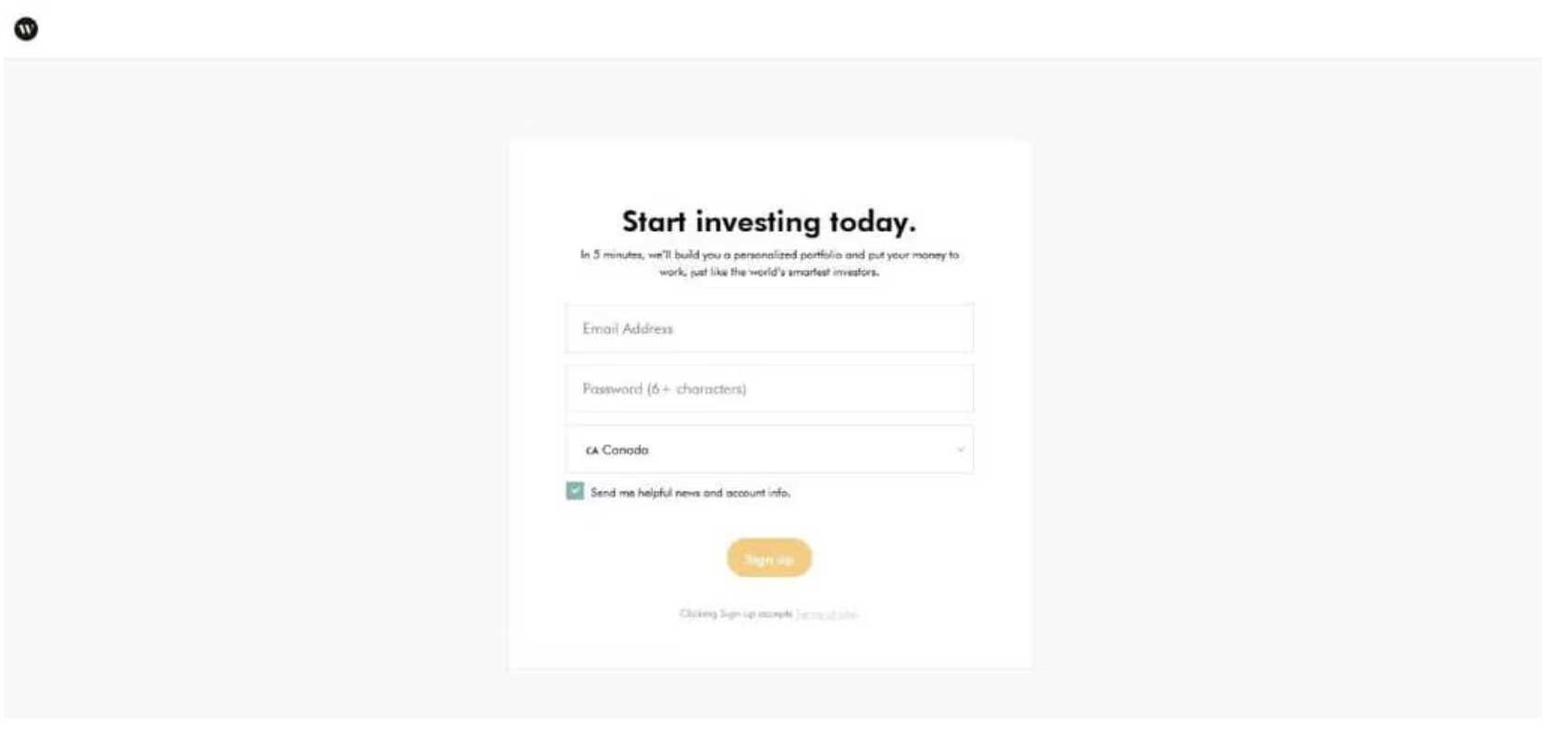

Wealthsimple has a sleek, user-friendly platform that provides all the details needed to make an informed decision about your investments. While some robo-advisors provide reams of financial information, Wealthsimple keeps the info overload to a minimum. There are only four options to choose from on the main menu, and only two of those deliver information about their products and services. Once you click on the “get started” option, you’re funnelled through the classic robo-advisor questionnaire designed to assess your needs, your time horizon and your risk tolerance. It’s that simple.

Wealthsimple claims to have the easiest and fastest sign-up process of all Canadian robo-advisors, clocking in at just five minutes. We went through the sign-up process and tested the portfolio-matching process.

Right off the bat, you need to create an account with a username and password. Then you’ll need to provide standard information like your employment details, address and social insurance number. This part takes about three minutes.

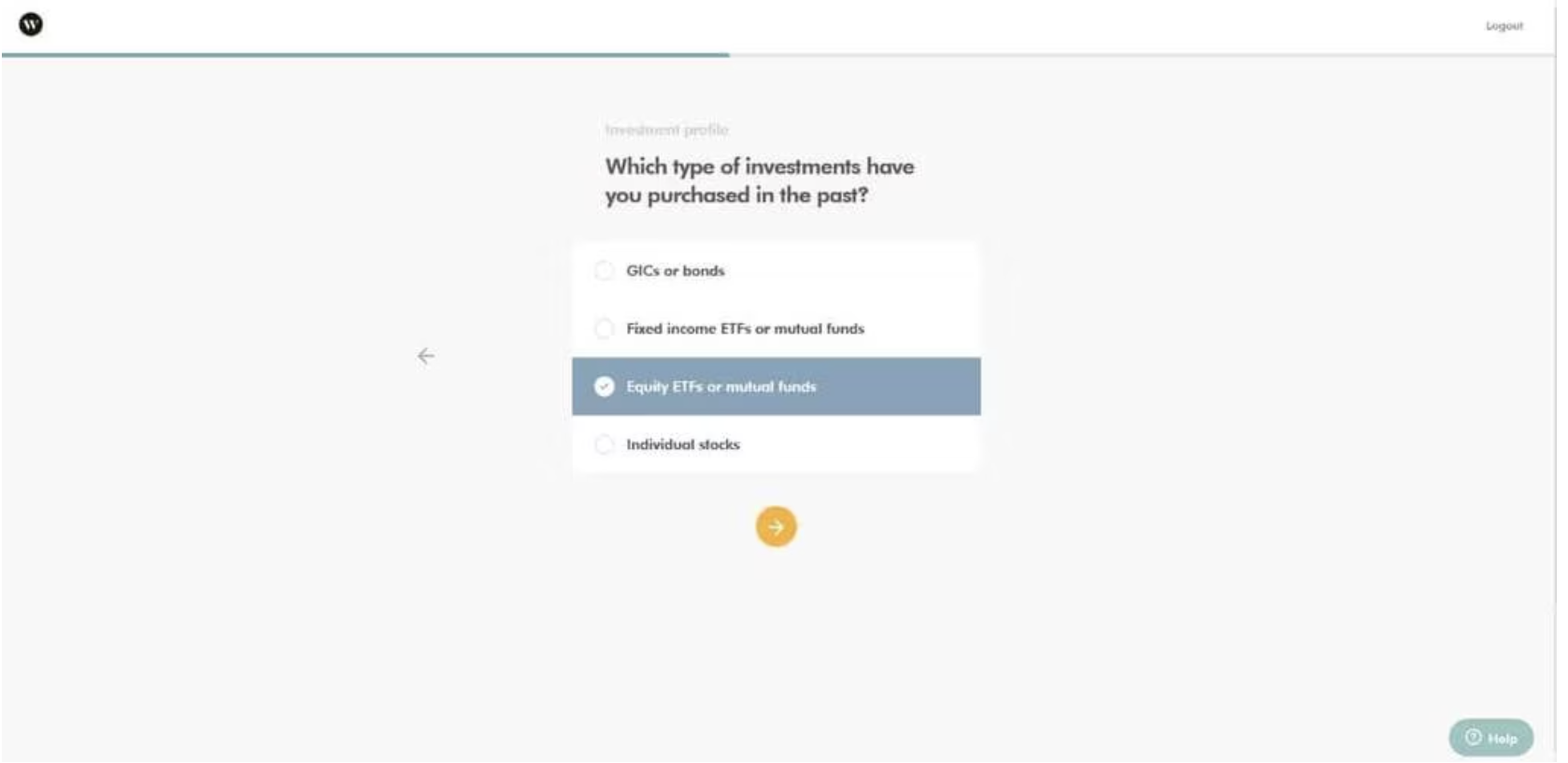

Once the basic information is covered, it’s time to go through the process of choosing your investments. Wealthsimple asks you the basic questions we expect of every robo-advisor, including questions about what investments you’ve purchased in the past.

Completing the questionnaire, Wealthsimple did show us which portfolio works: their “Growth” portfolio.

At this point, you can choose to make your portfolio socially responsible if you didn’t select that option in the questionnaire. We love that this screen shows projected Wealthsimple performance over time, but if you click on the “our assumptions” link they clearly state that past performance does not guarantee future results – essentially the opposite of the sales pitch you’d receive in a financial advisor’s office.

Next, we wanted to see where they were planning to invest the funds before pulling the trigger to sign up. Fortunately, that information was available farther down on the screen.

Next, opening an account: we were prompted to select which accounts we wanted to open. We had the option to open all of the standard accounts expected including savings accounts, TFSAs, and RRSPs.

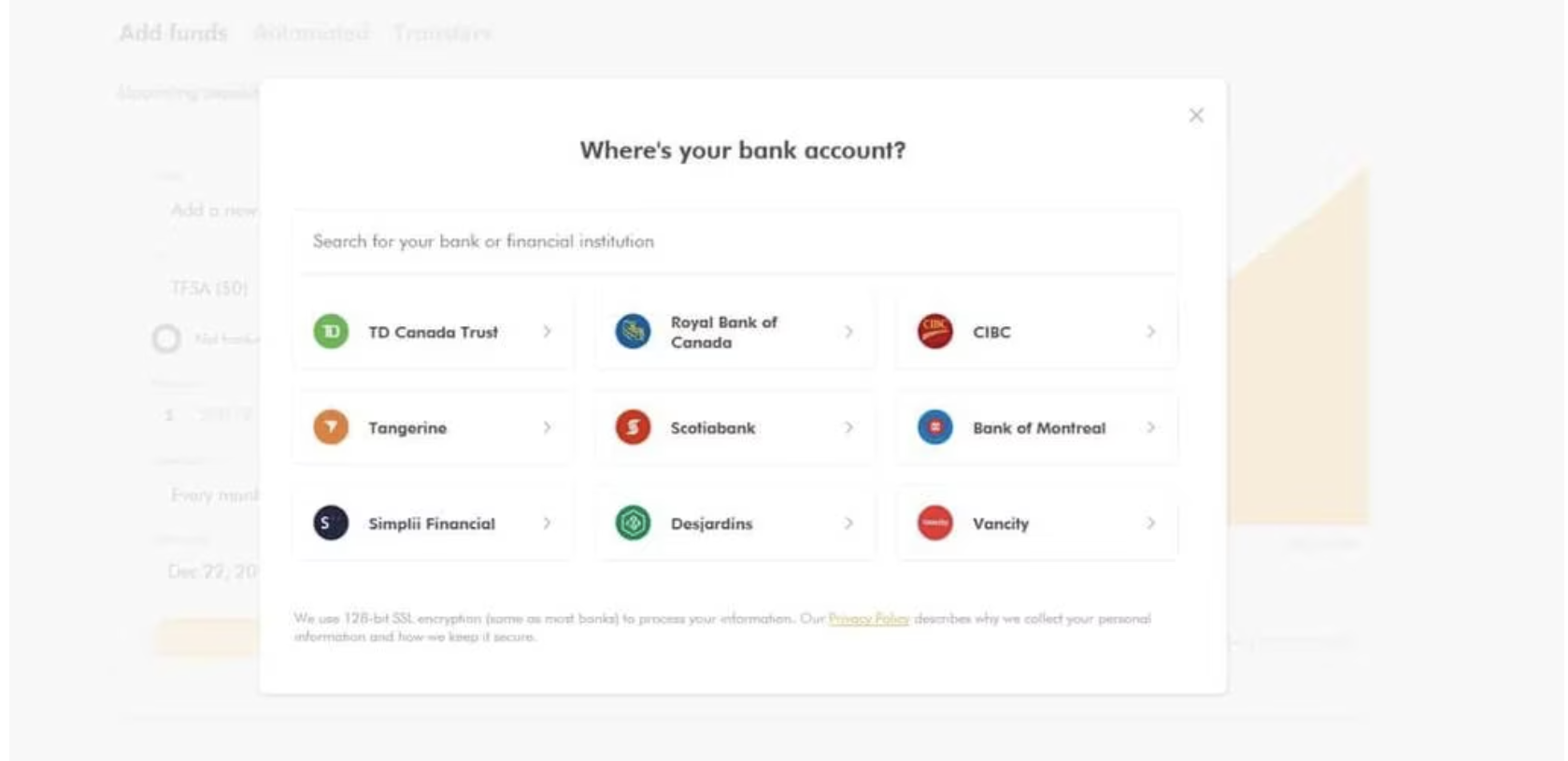

This stage of the account opening process is where some robo-advisors get a little dicey and confusing because sometimes linking bank accounts is an annoying process that requires submitting paperwork. With Wealthsimple, linking a bank account was surprisingly easy.

From there, it’s just a matter of setting up your automatic deposits, and you’re off to the races.

Sign up process

From our testing, it took less than 15 minutes to open a Wealthsimple account – much faster than lengthy meetings with a financial advisor. Plus, we found that the process of linking your Wealthsimple account to an external bank account was surprisingly easy. Here’s what’s needed to sign up:

- Your name, date of birth, and social insurance number

- Your email address

- Your phone number and address

- The login information for your online banking

The process of signing up is simple:

- Fill out an online application.

- Verify and connect a bank account by securely authenticating your online banking.

- You’re done! Your account should be set up in less than 5 business days.

The bottom line

Based on their competitive fees and excellent services, Wealthsimple is our top choice for the best robo-advisor in Canada. The Core portfolios are built from cost-effective ETF portfolios that minimize costs and volatility. In terms of usability, the platform is easy to use and accessible on mobile, and more information is available if you want to dig down. Above all, Wealthsimple excels by offering competitive fees for small accounts, great value on large accounts through Wealthsimple Premium and Generation, and some of the lowest ETF MERs in the industry.

The bottom line? Wealthsimple is ideal for the average Canadian investor and stands out as an extremely reputable robo-advisor that you can trust. It’s definitely a winner.

Editor’s note: This article was originally published in 2017 and is updated to represent the current changes. Please see Wealthsimple via our Apply Now button for latest details.

With files from Sandra MacGregor and Lisa Jackson

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.