-1694457674.jpg)

Wealthsimple Tax review

Wealthsimple / Wealthsimple

Updated: January 30, 2024

There are two types of filers out there: those who file their income taxes themselves, and those who pay someone else to do it for them. For me, the convenience of filing at home and not having to bring my tax documents to a professional is a huge benefit and the main reason I’m a die-hard DIY tax filer. That said, if I didn’t have access to online income tax filing software like Wealthsimple Tax, I might think twice about doing it myself.

Fortunately, Wealthsimple Tax exists to provide Canadians with an easy, secure, and most importantly, affordable means to file taxes. It’s a donation-based software that is best suited to those with a relatively simple tax situation, and while it does have some limitations (mainly flexibility and support), I nonetheless think it’s an excellent choice for most Canadians.

Our rating: ⭐️⭐️⭐️⭐️⭐️

Company overview

SimpleTax was founded in 2012 by husband and wife team Jonathan and Alison Suter, with the goal of offering Canadians a straightforward and inexpensive way to file their taxes online. The service has grown in popularity since its inception because technically it is free to use, invoking an unusual donation-based fee system that asks customers to “pay what you want” – or nothing at all, even for those filing multiple returns. This flexible pricing, paired with a genuinely easy-to-navigate user interface, makes Wealthsimple Tax one of the premier affordable income tax filing services in Canada.

Popular robo-advisor Wealthsimple purchased SimpleTax in 2019, rebranding it to Wealthsimple Tax.

Special features

Here’s what you can expect from this year’s iteration of Wealthsimple Tax. Since this is a donation-based service, there are no “tiers” of products, and users can benefit from all of these features when they file their income tax returns:

- NETFILE approved

- Meets CRA requirements for encryption and privacy

- Refund is dynamically calculated as you enter your tax details

- Import previous year’s return

- Return auto-filling – import your data directly from the CRA

- Step-by-step guidance – answer a few simple questions to customize your return

- Can handle self-employment, small business, and investment property income

- Smart search function makes finding the right deduction easy

- Auto-fills your return with cryptocurrency gains/losses from over 300 exchanges and wallets

- Free support available via email, chat, and phone

- Refund optimization – including splitting donations and pension income

- RRSP maximization calculator – maximize your RRSP for the highest possible refund

- Maximum refund guarantee – Wealthsimple Tax includes pension splitting, spousal dividend claims, and carryforward amounts to maximize your refund

- Re-file functionality – make adjustments after you’ve already filed

Pricing

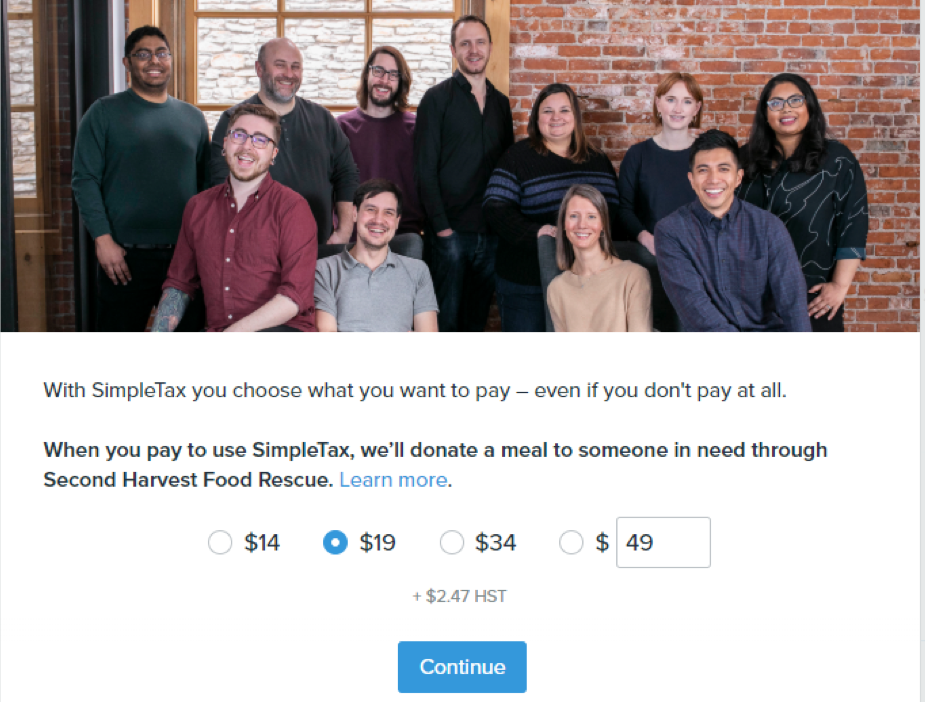

While other online tax platforms have pricing tiers that may be confusing or convoluted, Wealthsimple Tax’s pricing scheme is straightforward: it’s 100% free. That said, they do recommend that you donate to use the software: Their default donation is $19, and most users seem to donate around $10–$20.

How it works

Step 1: Create an account

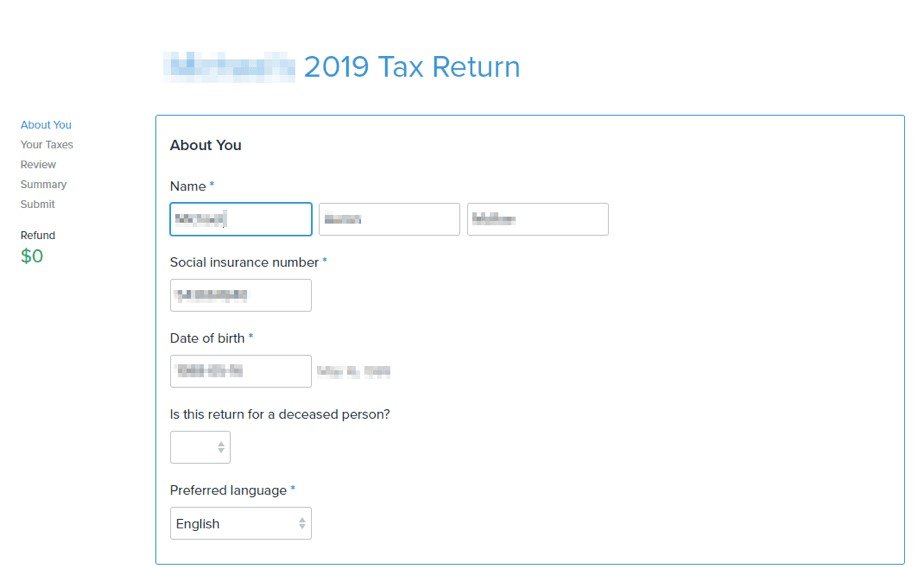

To get started with Wealthsimple Tax, you can go to their website and click the blue “Start your tax return” button. From there, you will make an account and start by filling out your necessary information, including your name, date of birth, address, marital status, province of residence, and whether you are registered with the CRA.

Alternatively, if you are already a Wealthsimple customer, you can file your taxes from your Wealthsimple dashboard. When you log into your Wealthsimple account, click the “Taxes” option in the top menu bar, and you’ll be taken to Wealthsimple Tax through the Wealthsimple portal. Finally, Wealthsimple Tax is also available in the Apple Store.

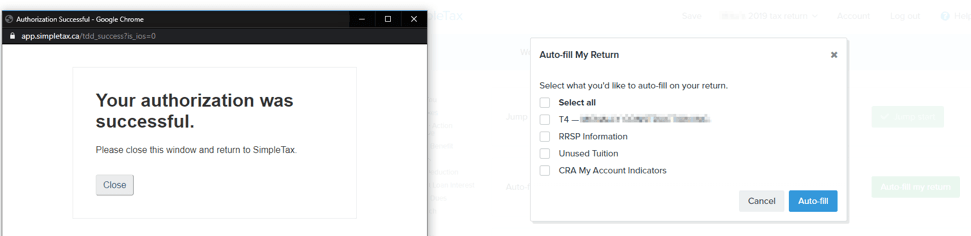

Step 2: Auto-fill your return

Once these basic questions are complete and you’ve linked your CRA account, Wealthsimple Tax will import any documents available from the CRA to auto-fill your return and streamline the process.

Step 3: Enter tax details

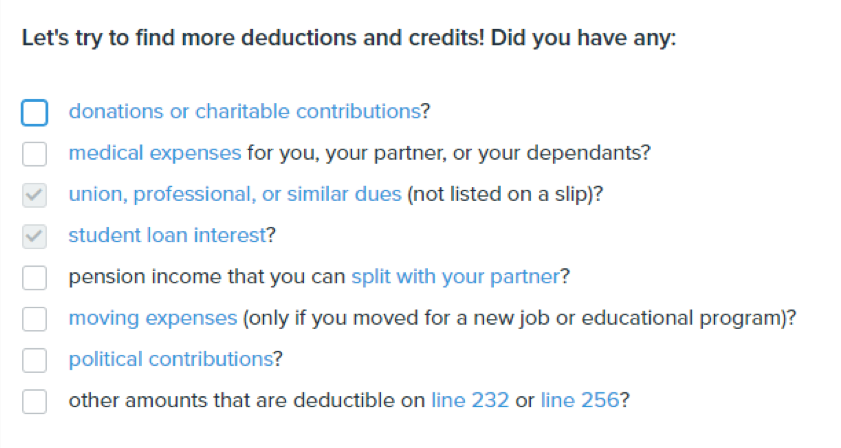

Wealthsimple Tax will also ask you a series of questions about your tax situation, income, and investments. This allows the platform to determine which deductions you’ll qualify for, and to formulate the rest of your return. You can monitor your progress and your refund using the navigation menu on the left-hand side of the screen.

Step 4: Review before submission

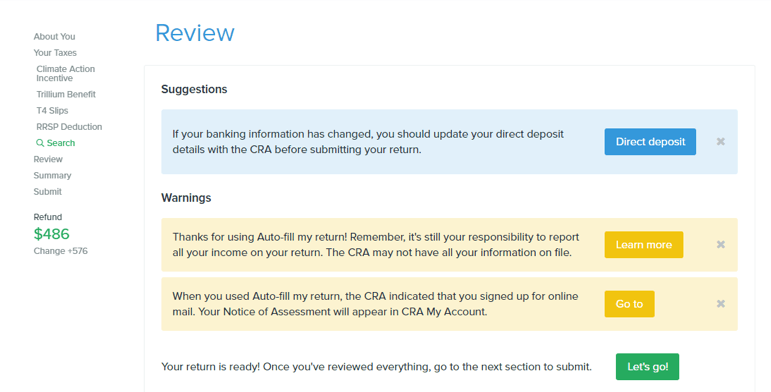

After you’ve entered any additional investment information, T4s, and claimed all of your deductions, you’ll have a chance to review your tax summary. If there are any warnings or suggestions, Wealthsimple Tax will allow you to address them.

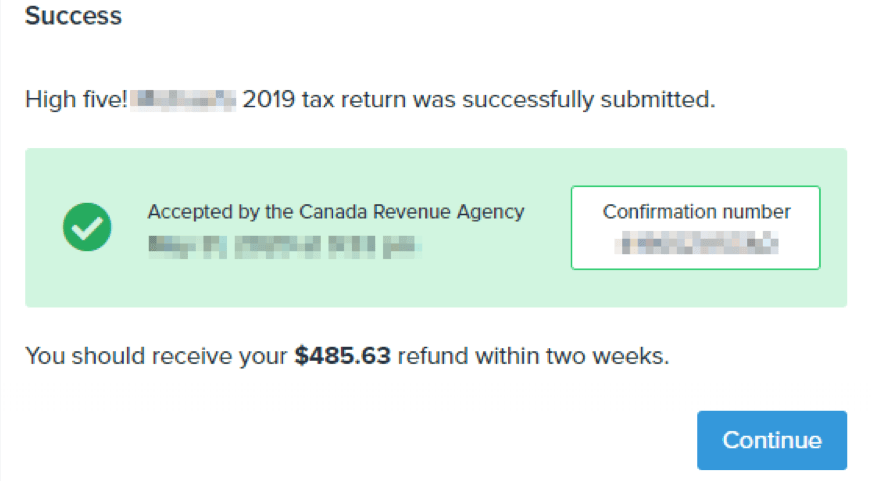

Step 5: Submit tax return

Once you’ve finished reviewing your return, you can submit it using the CRA NETFILE functionality. If you have direct deposit with the CRA, you should receive your income tax refund within two weeks of submitting your return.

Step 6: Consider paying

As I’ve mentioned, Wealthsimple Tax is entirely free, but they do suggest you donate if you can afford it. The pay screen below can be modified to any amount, or you can choose from one of their suggested donations.

And that’s that. You can also check out the below video for an in-motion glimpse into how the platform works:

Customer support

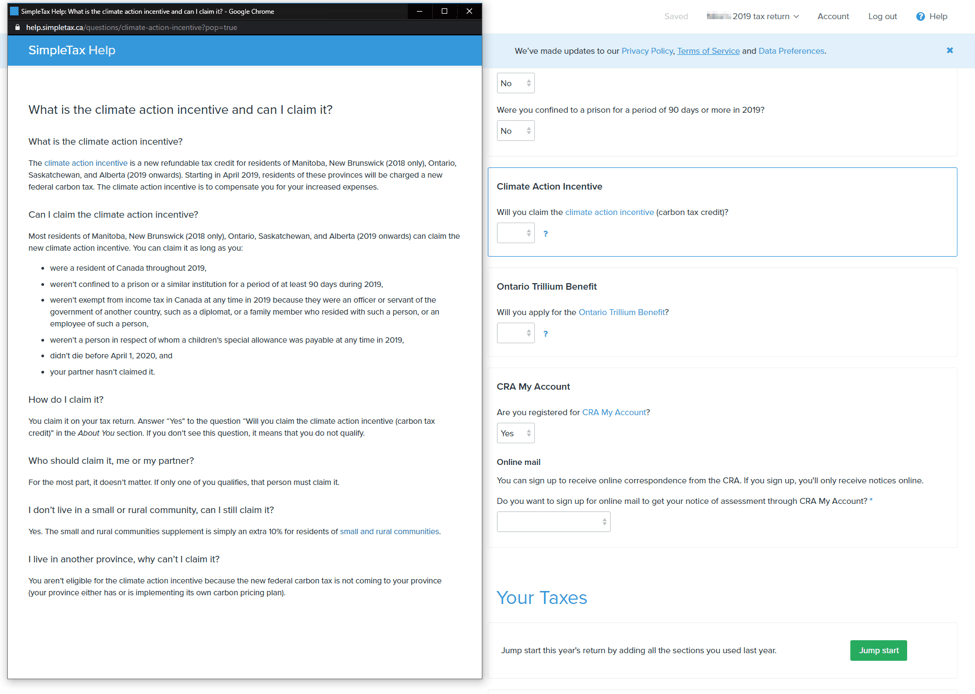

Wealthsimple Tax offers support via phone, email, and chat, however it’s more for answering questions about using its software (not general tax questions or advice inquiries). For tax-specific questions you can access Wealthsimple Tax’s extensive knowledge base. If you have a question about your taxes while you are going through the filing process, Wealthsimple Tax’s helpp section is easy to access by clicking on the hyperlinked parts of each tax question, such as the article about the new Climate Action Incentive shown below.

How Wealthsimple Tax compares

Wealthsimple Tax’s donation-based fee model is appealing to those on a tight budget, but it’s always a good idea to check out the competition before committing to any product.

When comparing these three tax platforms it’s important to consider what is offered by each for its basic free version, and who can use it. With TurboTax and H&R Block, qualifying for the free version requires a very straightforward financial situation, for example someone with only T4s and RRSP contributions, but no self employment income, rental properties, medical expenses, or unregistered stocks or investments. Here are some features that come with Wealthsimple Tax, but which are not available in the free versions of TurboTax or H&R Block:

- transferring your information forward from previous years

- automatic RRSP optimization

- automatic searching for applicable deductions and credits

- access to some areas of support

Accessing these features in TurboTax or H&R Block requires an upgrade to a paid tier. Further upgrades on those platforms will allow you to access extra features like a dedicated, priority phone support line from H&R Block, or Audit Defense, in which TurboTax will represent you in the event of an audit by the CRA. These paid features are excellent if you’d like expert oversight while filing your taxes, and may be beneficial if you have a complicated tax situation or are filing for the first time.

One noteworthy new feature that’s unique to Wealthsimple Tax is the ability to calculate your capital gains on cryptocurrency. The program supports over 300 exchanges and wallets, including NDAX, Coinberry, Shakepay, and Bitbuy, and will automatically import your transactions, find market prices at the time of your trades, and match transfers between wallets. For crypto traders, this is a huge benefit over the other tax software options out there.

Wealthsimple Tax pros and cons

Wealthsimple Tax offers many benefits, but it’s not perfect. Here’s where Wealthsimple Tax excels and where it falls short.

Pros

-

User-friendly interface

-

Free (donations encouraged)

-

NETFILE certified

-

Safe and secure

-

Suitable for most Canadian tax situations

-

Auto-fill for crypto traders

Cons

-

Lacks extra add-ons like audit defense or expert tax review

-

Maybe a bit too bare-bones for nervous or first-time filers

-

May not have enough sophistication for all business owners, income property owners, those who are not residents of Canada, or those who have recently emigrated from Canada

-

Limited customer support

Who should use Wealthsimple Tax?

For both new and experienced tax filers, Wealthsimple Tax offers an inexpensive and easy way to file your taxes directly with the CRA. While their support options are somewhat limited, Wealthsimple Tax is still a good option if your tax situation is straightforward or if you’re a crypto trader, and I certainly wouldn’t hesitate to use this software for my tax filing needs.

Those who are on the fence might elect to at least start the tax filing process with Wealthsimple Tax; if it becomes clear to you that your tax situation requires extra attention and personalized advice, you can always jump ship to a more robust, paid platform before submitting your return.

Submit your tax return with Wealthsimple Tax

Related articles:

- Tax changes Canadians need to know about

- Tax credits vs. tax deductions

- Should you pay income taxes with a credit card?

- Wealthsimple Crypto review

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.