Find the best mortgage rates in Alberta

See the best mortgage rates in Alberta, all in one place.

Best mortgage rates in Alberta

Why you should compare mortgage rates in Alberta

Due to a rapidly growing population, Alberta has one of the most competitive housing and mortgage marketplaces in Canada. With a limited supply and increasing demand, it’s more important than ever for you to shop around when it comes to securing your mortgage. We are here to help you find the best Alberta mortgage rates. Once you’ve clicked on the best rate from our table, we connect you to a mortgage broker who can finalize your documentation or find a better mortgage for your financial situation.

Knowing the mortgage rule

Before you start looking for a mortgage, it is important to know what you can afford. Using the 20/30/3 rule, you can easily calculate your mortgage affordability.

- 1.

20% down on your mortgage (to avoid mortgage insurance)

- 2.

Household expenses (e.g. mortgage, insurance, maintenance, utilities, etc.) should be less than 30% of your gross household income.

- 3.

The price of your home should be less than three times your gross household income.

How to use our Alberta mortgage rates table

Use our Alberta mortgage rates table to secure the best rate, in these quick and easy steps:

Choose one of the following:

Purchase: If you’re simply buying a home, use the Purchase type for your mortgage. This is a loan from the lender to cover the cost of your property minus the down payment. Your mortgage rate factors in your credit score, total down payment, income, loan size and term.

Renewal/switch: Whenever your mortgage term ends, you’ll need to renew the term if you still owe money on your house. You have the option of continuing with your original lender or shopping around for a better rate and switching. Keep in mind that switching lenders may involve much more paperwork and costs, such as appraisal or transfer fees, but the long term savings can be significant in comparison.

Refinance: A mortgage refinance is when you break your existing mortgage and get a new one, either with your current lender or a new one. Refinancing helps you negotiate better terms as you get a lower rate, access home equity or consolidate debts. It’s important to note that whenever you break your mortgage to refinance, you can incur prepayment penalties.

Select Alberta as your province.

Input your home’s appraised value or the best estimate.

All of these inputs depend on your current situation and loan requirements. The down payment is how much you are paying on your own. The remaining balance is how much you have owing. The desired mortgage amount is your required loan amount.

Choose which term and rate fits your needs. You can see the best Alberta rates on our table.

Easily sort by the lowest rate, then choose your preferred mortgage provider and select “get this rate” to start your application process.

What is a mortgage rate?

A mortgage rate is the rate of interest charged on mortgage loans by the issuing lender. Alberta mortgage rates refer to the interest rates charged by lenders in Alberta, Canada. These rates help you determine the cost of borrowing money to purchase any type of home. In Alberta, mortgage rates can vary depending on the mortgage type, lender, term and borrower’s financial standing. In a nutshell, mortgage rates determine what kind of home you can afford.

Understanding your Alberta mortgage rate

Having a thorough understanding of your mortgage is crucial, as it can affect the following:

- Budgeting: Understanding the rate you'll pay, whether fixed or variable, open or closed, empowers you to budget effectively for the most important investment of your life, your home. Being financially savvy, strengthens your budget planning throughout the mortgage period, ensuring proper financial stability.

- Cost of borrowing: Mortgage rates directly impact your total cost of borrowing. Even a slight increase or decrease can greatly affect how much interest you pay both monthly.

- Rate comparisons: Understanding rates can allow you to compare different mortgage lenders and mortgage products more effectively, as you’ll know what best suits your needs. Flexible benefits like no prepayment penalties can really be a game changer.

- Risk management: Given market volatility right now, it’s always best to understand how your financial risk can change with significant rate increases. This is crucial if you have a variable rate, as each rate increase can have a big impact on your monthly payments and amortization. Even if you’re locked in at a fixed rate, high interest rates can affect your renewal rates and your home value if you’re looking to refinance.

- Negotiation power: When you have a deeper understanding of mortgage rates and the factors that affect them, you can negotiate the best terms with your lender.

How can I get the best mortgage rate in Alberta?

You can secure the best mortgage rate in Alberta with these simple steps:

1. Boost your credit score: Always pay all your bills on time, lower debt and check for errors on your credit report. Remember to keep your credit card spending at 30% of your limit.

Read more: How to improve your credit score.

2. Save for a bigger down payment: When you save for a larger down payment, 20% or more, you can find better mortgage rates and eliminate the need of mortgage insurance, which are both significant money-saving advantages.

3. Compare mortgage rates and lenders: Before you secure a rate, always remember to shop around and compare the best mortgage rates from banks, credit unions and mortgage brokers.

4. Negotiate: You should never hesitate when it comes to negotiating for a better rate – even a small difference can save you a lot money in the long run.

5. Use a mortgage broker: Having a mortgage broker can be very beneficial as they can help you secure a great deal and negotiate on your behalf. Saving you both time and money!

6. Time it right: Closely monitor Alberta real estate market trends and apply for a mortgage when conditions are the most favourable.

7. Consider all your costs and mortgage features: Don't simply focus on your potential mortgage rate. It's very important to look for perks that you may benefit you later, like prepayment options and mortgage portability.

8. Strengthen your finances: Lowering your debt, increasing your overall income, or picking a property within your budget can make you look more attractive to lenders.

9. Lock in a rate: If rates might go up soon, always get a rate hold for 90-120 days while you shop around.

10. Choose the right mortgage type and term: Decide between fixed or variable rates and consider how the term length affects your rates, monthly payments, renewal frequency and personal budget.

Fixed rate mortgages vs. variable-rate mortgages in Alberta

Deciding between a fixed and variable mortgage rate depends on your financial situation, overall risk tolerance and the economic climate.

Here's a breakdown of the differences and considerations for each type:

Two other mortgage types in Alberta that are gaining popularity.

- 1.

Adjustable-rate mortgages (ARMs): ARMs are akin to variable-rate mortgages since the interest rate can fluctuate. With an ARM, your monthly payments adjust along with the interest rate. While you can certainly enjoy lower payments during times of low interest rates, it's crucial to consider the financial risk of a substantial increase. Make sure you have a solid back up plan in place. Scotiabank’s Flex Mortgage is a great example of an ARM.

- 2.

Hybrid mortgages: Hybrid mortgages divide the loan amount into various segments, each with its own rate type (fixed, variable or adjustable). This strategy helps spread your risk during rate fluctuations. A hybrid mortgage combines the stability of fixed rates with the cost savings of variable interest rates. Hybrid mortgages are complex, so it's essential to fully understand the terms and conditions outlined in your contract. A good example of such a mortgage product is Meridian Credit Union’s Hybrid Mortgage.

How to choose between variable vs. fixed mortgage rates in Alberta

You should consider the following factors when choosing between a variable and fixed rate mortgage.

Consider the risks

- If you prefer consistent payments and would feel stressed by potential rate and payment increases, a fixed rate might suit you better.

- If you're comfortable with payment fluctuations and believe rates will remain stable or decrease, a variable rate might be preferable.

Monitor the economic environment

- In a low-rate environment expected to rise, opting for a fixed rate could lead to long-term savings.

- If rates are high but anticipated to fall, or if stability is expected, a variable rate might be more advantageous.

Understand your finances

- Assess your ability to handle potential payment increases. A fixed rate offers security for those with tight budgets.

- If you have flexibility in your finances or an emergency fund to absorb rate changes, the lower initial rates of a variable mortgage could be beneficial.

It's all about finding a balance between financial stability, risk tolerance and potential rate fluctuations. Seeking advice from a financial advisor or mortgage broker can aid in making a well-informed decision based on your unique financial situation and the prevailing economic conditions.

How are Alberta mortgage rates determined?

Mortgage rates in Alberta, as in the rest of Canada, are affected by several different domestic and international factors.

Here all all the factors that affect Alberta mortgage rates:

- Bank of Canada's policy interest rate: The Bank of Canada’s (BoC) overnight rate directly impacts the prime rates that banks charge their customers. This has a direct correlation with variable mortgage rates as any change can directly impact them. On the other hand, fixed mortgage rates, while influenced by the policy rate, are directly impacted by a change in the overnight rate. They are more directly tied to the bond market. A higher policy rate can lead to higher mortgage rates and vice versa.

- Bond market: Fluctuations in government bond yields, particularly 5-year Canadian government bonds, have a direct impact on fixed mortgage rates. When bond yields rise due to factors such as inflation or better returns from alternative investments, banks tend to raise fixed mortgage rates to maintain profitability.

- Economic conditions: Mortgage rates can be influenced by the overall economic health. During periods of economic growth, rates may increase due to heightened credit demand and inflation expectations. But during economic downturns, the Bank of Canada might lower rates to encourage borrowing and investment.

- Inflation: The Bank of Canada targets inflation within a specific range and high inflation may result in lenders demanding higher mortgage rates to offset reduced purchasing power over time.

- Lender's funding costs: Mortgage rates are also affected by the costs incurred by lenders to obtain the funds they lend out. These costs vary based on factors like mortgage demand and the lender's funding sources.

- Regulatory changes: Government policies, such as alterations to mortgage qualification rules or capital requirements for banks, can influence mortgage rates.

- Lender competition: The level of competition among lenders in Alberta can impact mortgage rates, with higher competition potentially leading to lower rates as lenders compete for borrowers.

- International events: Global economic events and trends can influence Canadian mortgage rates. For example, increased demand for Canadian bonds due to global economic stability can lower bond yields and subsequently fixed mortgage rates.

- Gross Domestic Product (GDP): The overall economic health, as measured by GDP, can affect mortgage rates. A strong economy may lead to higher rates due to increased credit demand, while a weak economy may result in lower rates to stimulate borrowing.

- Employment rates: Levels of employment can influence housing demand and, consequently, mortgage rates. Higher employment may push rates up, whereas higher unemployment may lead to rate decreases as lenders seek to encourage borrowing.

- Consumer confidence: Consumer confidence and spending habits can impact economic growth and by extension, mortgage rates. Increased consumer confidence and spending may lead to higher rates, while cautious consumer behavior may result in rate reductions.

While these factors offer insights into what determines mortgage rates in Alberta, the specific rate offered will also depend on individual factors such as credit score, down payment, amortization period and the type of mortgage (fixed or variable).

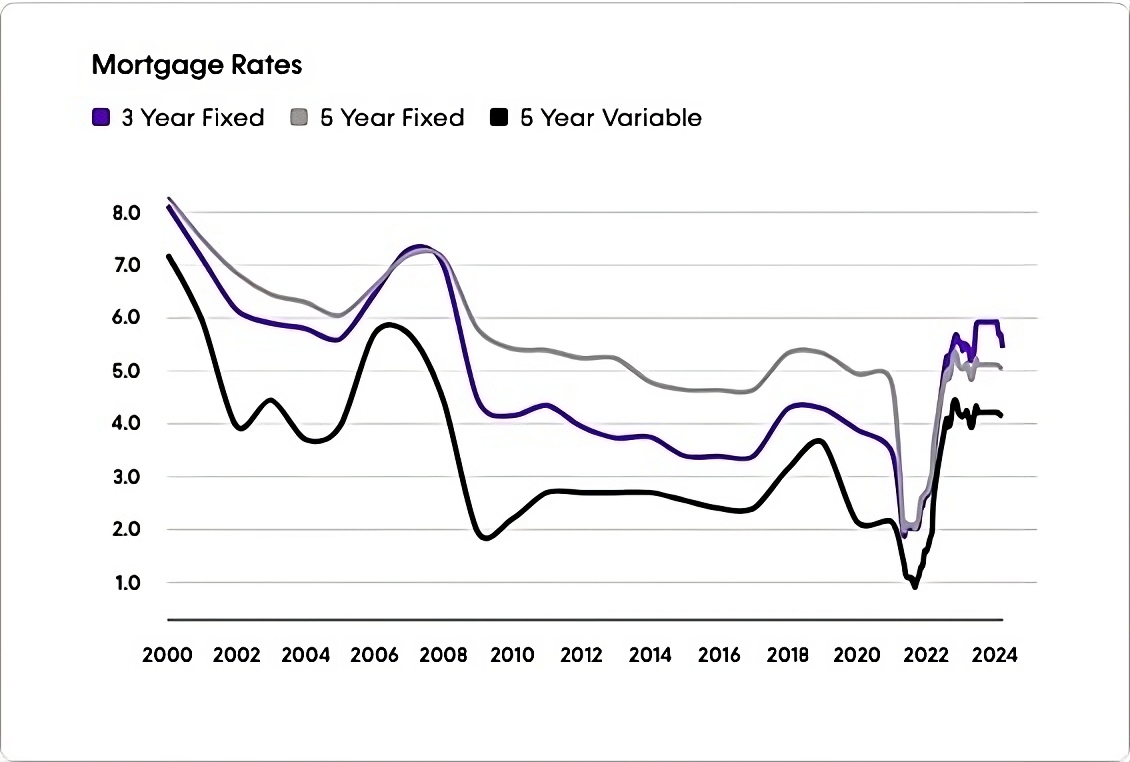

Historical Alberta mortgage rate graph

Alberta’s current housing market

According to the latest figures released by CREA, Alberta continues to exhibit characteristics of a highly competitive housing market, a notable trend that persists as steady sales contributed to a 11.1% year-over-year gain in August.

In August alone, a total of 7,368 houses were sold across Alberta, representing a slight slowdown from the previous month's figure of 8,254, and a 1.7% year-over-year decline.

New listings also increased by 6.3% year-over-year, but market conditions tightened as inventory levels slightly went down by 6.6%, continuing a monthly declining trend. The sales-to-new listings ratio held steady at 71%. There were 2.38 months of supply in August, down 4.9% year-over-year.

The average home price in Alberta experienced an 11.1% uptick on a month-to-month basis, with the average price recorded in August being $494,920, on the higher side compared to July’s $486,828. This amount is lower than the average home price in June, which was $503,502, signaling a notable shift in market conditions.

The top two cities in the province of Alberta, Calgary and Edmonton, saw impressive market activity in August. Calgary recorded 2,185 actual residential sales in August with both new listings and inventory on the rise and a 16% hike in average residential price at $609,000.Edmonton also reported a 12% year-over-year rise in actual sales with 1,781 units sold. The average price of a residential home in Edmonton was $404,000 in August, 5% higher compared to last year.

During August 2024, a total of 10,445 residential properties were introduced to the market, which signifies a slight contraction from the total of 11,494 in July and 11,848 properties available in June. However, this total reflects a commendable increase of 6.3% when looking back at August 2023. Given this situation, coupled with the decline in demand and the relatively high influx of new listings, the overall buying conditions within Alberta’s competitive housing market have eased, creating a slightly more favorable environment for potential homebuyers.

Alberta's new mortgage rules for 2024

The federal government has introduced major revisions to Canada's homebuying rules, set to take effect on December 15, 2024.

- 30-year amortization: First-time home buyers and those purchasing newly built homes in Alberta are now eligible for mortgages with a 30-year amortization period.

- Higher purchase price for all insured mortgages in Alberta: The highest price for an insured mortgage (with a down payment of less than 20%) will go up from $1 million to $1.5 million.

Understanding the impact BoC announcements on your Alberta mortgage

Keeping up with BoC announcements is highly important when renewing or securing your first mortgage because they greatly affect mortgage rates. Understanding the importance of these announcements can help make better financial decisions when it comes to managing your mortgage.

Here's how BoC announcements can affect your mortgage rate:

- For variable rate holders: If you have a variable-rate mortgage or are considering one, monitoring BoC announcements is essential. They provide insight into potential changes in your interest costs, helping you decide whether to lock in a fixed rate or adjust your budget accordingly.

- For fixed rate holders: While BoC announcements may not have an immediate impact on fixed rates, understanding the central bank's economic outlook can offer valuable insights into long-term trends. For instance, if the BoC expresses concerns about rising inflation, it may signal future interest rate hikes, influencing your decision to secure a fixed rate sooner rather than later.

Why picking the lowest mortgage rate isn’t always ideal

Finding the best mortgage rate isn’t solely about securing the lowest interest rate but also about selecting terms and conditions that align with your financial situation and objectives. It is always best to seek guidance from a financial advisor or mortgage broker who can provide personalized advice tailored to your specific circumstances.

While a low rate may seem attractive for saving on interest payments, there are other equally important factors to consider, such as:

Flexible terms and conditions: Certain mortgages with very low rates may come with strict terms and conditions that restrict your flexibility. For instance, the ability to make extra payments, increase regular payment amounts, or pay off the mortgage early without facing significant penalties may hold more value in the long run than opting for a slightly lower interest rate.

Prepayment privileges: Prepayment privileges allow you to pay off a portion of your mortgage principal early without incurring any penalties. Mortgage lenders offer various prepayment options that can allow you to make flexible payments, significantly reducing the interest paid over the life of your mortgage.

Penalty fees: Understanding the penalties for breaking your mortgage before its term is crucial, particularly when it comes to fixed-rate mortgages. Some lenders calculate penalties using interest rate differentials, which could be substantially higher than others that utilize a more straightforward three-month interest formula.

Mortgage portability: When you have a portable mortgage, you can easily transfer your existing mortgage to a new property without paying any penalties. This feature is great if you are planning on moving before your mortgage term ends.

Assumability: An assumable mortgage enables a future buyer of your home to take over your mortgage at its current rate and terms. This can be an appealing selling feature, especially if interest rates have increased since you locked in your mortgage.

Mortgage lender: The choice of mortgage lender is critical and can significantly impact your mortgage experience. Understanding the various types of mortgage lenders is essential in making an informed decision.

Considering these factors can help you secure a mortgage that not only offers a competitive rate but also aligns with your broader financial goals.

Get the lowest mortgage rate through HomewiseTypes of Mortgage Lenders in Alberta

In Alberta, you'll find numerous mortgage lenders, each with their own range of mortgage products, terms and service levels. Knowing the types of lenders can help you make a smart decision when looking for a mortgage. The main types of mortgage lenders in Alberta are:

1. Banks

In Alberta, banks are the most traditional and common source of mortgage financing. They fall into the category of “A” type mortgage lenders. “A lenders,” are traditional lenders who cater to customers with good credit scores and reliable income. They can provide you different types of mortgages like fixed-rate, variable-rate and adjustable-rate, just to name a few. Banks usually have strict requirements for qualification, but they might offer lower rates if you have good credit history. However, just because Canadians prefer banks over other types of lendersdoesn’t mean that they have the lowest interest rates. It’s always good to compare different lenders in the market.

Here are the most popular banks who provide mortgages in Alberta:

- Royal Bank of Canada (RBC): Founded in 1864, RBC is one of the largest banks in Canada. RBC provides a wide range of mortgage options, including fixed and variable-rate mortgages, along with specialized products for first-time homebuyers.

- Toronto-Dominion Bank (TD Bank): TD Bank offers a variety of mortgage solutions, including fixed and variable-rate mortgages, as well as home equity lines of credit (HELOC).

- Bank of Montreal (BMO): BMO offers highly competitive mortgage rates and options, including fixed and variable-rate mortgages, along with special programs for first-time buyers.

- CIBC: CIBC has many mortgage products, including fixed and variable-rate mortgages, as well as a Home Power Plan that combines a mortgage with a line of credit.

- Scotiabank: Founded in 1832, Scotiabank is one of the oldest banks in Canada. They offer a broad range of mortgage options, including fixed, variable-rate and adjustable-rate mortgages. They also provide the Scotia Total Equity Plan, allowing homeowners to utilize their home equity to reduce borrowing costs.

- National Bank of Canada (NBC): Although more prominent in Quebec, National Bank also offers mortgage products in Alberta, including fixed and variable-rate mortgages, along with offers for first-time homebuyers.

- Desjardins Group: Primarily based in Quebec, Desjardins extends mortgage products into Alberta, including fixed and variable-rate options.

- Equitable Bank: A smaller bank compared to others, Equitable Bank offers competitive mortgage rates and products, including fixed and variable-rate mortgages.

2. Credit unions

Credit unions are owned by members and often offer more personalized service than banks. While they may offer similar mortgage products, they can sometimes provide more flexible terms or better rates, particularly for their members. Keep in mind that, like banks, credit unions are also regulated provincially, which can affect their mortgage products.

Here’s some examples of credit unions in Alberta:

- Connect First Credit Union Ltd.

- Encompass Credit Union

- Lakeland Credit Union

- Rocky Credit Union

- Servus Credit Union

- Vermilion Credit Union

- Vision Credit Union

See the CMHC approved list of lenders in Alberta to see all of the credit unions available to you in the province.

3. Online banks

Online banks are gaining traction among Alberta residents as their low overhead expenses allow them to easily extend lower interest rates or cash-back incentives to mortgage applicants.

Here are some examples of online bank mortgage lenders in Alberta:

- Tangerine: Renowned as one of Canada's leading online banks, Tangerine offers portable mortgages. Established in 1997, it was formerly known as ING Direct.

- Nesto: Positioned as Canada's most trusted online mortgage lender, nesto delivers a seamless home financing experience with the support of over 300 advisors.

- Bridgewater Bank: Founded in 1997, Bridgewater Bank continues to offer a wide array of mortgage products in Alberta, including unique options such as Self Employed mortgages.

- First National: As one of Canada's largest non-bank mortgage lenders, First National specializes in both residential and commercial mortgages. Established in 1988, it offers a diverse range of mortgage solutions.

- Simplii: Recognized for its cash back incentives across credit cards, high-interest bank accounts, and mortgage rewards programs.

4. Trust Companies

Trust companies provide a range of financial services, including mortgage lending. If you have an unconventional source of income or poor credit, you can look at trust companies to help you secure a mortgage. Trust companies may offer competitive rates and terms, especially for investment properties. Here are some examples of trust companies in Alberta:

- Home Trust Company: A comprehensive mortgage lender offering mortgage products, Visa cards and deposit services in Alberta.

- Equitable Trust Company: Actively involved in providing deposit services and originating mortgages in provinces like Alberta, British Columbia and Manitoba.

- Community Trust: Provides you residential mortgages, term deposits, GIC and a flexible maximizer savings account. Community Trust powers Questrade's Questmortgage program.

See the Government of Alberta’s comprehensive list of loan and trust companies.

5. Mortgage Investment Corporations (MICs)

Mortgage Investment Corporations (MICs) pool money from investors to extend mortgages to borrowers. They frequently target specialized markets like commercial properties or individuals who don't meet conventional lending standards. While MICs may provide greater flexibility in lending criteria, they might also impose higher interest rates.

Here are some examples of Mortgage Investment Corporations (MICs) acting as mortgage lenders in Alberta:

- AP Capital MIC: AP Capital MIC focuses on urban markets in Western Canada, mainly British Columbia and Alberta. The majority of AP Capital's mortgages are for non-owner occupied homes, such as second homes or investment properties.

- Atrium MIC: ATRIUM® has been providing Canadians creative financing solutions since 2001 and is one of Canada's largest mortgage investment corporations.

- MCAN: Provides homeowners with customized and unique mortgage solutions such as the CAN Home No-Frills mortgage and the Precision Prime mortgage.

6. Private Lenders

Private lenders are individuals or firms providing personal loans, including mortgages, especially to borrowers struggling to secure financing through conventional methods. While they may offer loans with more lenient qualification criteria, private lenders usually charge higher interest rates and fees to compensate for the heightened risk.

Here are a few examples of private mortgage lenders in Alberta.

- THINK Financial: A great option for those looking for short-term financing for their mortgage needs.

- First Foundation: Provides quick, short-term private mortgage products to those who don’t qualify for mortgages from traditional lenders.

- Freedom Capital: Offers private mortgage solutions across Canada, even to those with bad credit history and low income.

7. Online Lenders

Services from online mortgage lenders are accessible via digital platforms, featuring simplified application and approval processes. Online mortgage lenders frequently offer competitive rates and adaptable terms, particularly advantageous for borrowers with excellent credit standings. Online lenders vary from conventional banks with online services to fintech companies specializing in digital financial solutions.

Choosing the best mortgage lender in Alberta

When selecting a mortgage lender in Alberta, you must always take into account factors such as the offered interest rates, fees, penalties, flexibility in terms and the level of customer service. It’s always smart to seek guidance from a mortgage broker to see what your options are. Mortgage brokers, while not lending money themselves, collaborate with banks, trust companies and credit unions to negotiate the best rates and terms on your behalf. Don’t be afraid to ask them any questions about any concerns or mortgage needs that you have. It’s their job to do the legwork and contact multiple lenders at no cost to you, as they are compensated by the lender.

However, even when a broker presents you with a mortgage lender, do your own homework and inquire about the lender's suitability because until your term renews, your interactions will primarily be with the lender directly. Here's how to determine if the recommended lender is a good fit for you.

Evaluating a mortgage lender in Alberta

When assessing a mortgage lender in Alberta, it is important consider the following factors:

- Interest rates: A lower interest rate may sometimes be accompanied by stricter conditions or higher fees, so always read the fine print before securing a mortgage.

- Fees and penalties: Ensure transparency regarding all associated fees, penalties, and terms, including early mortgage termination and lender switching.

- Market reputation: Seek out lenders known for exceptional customer service. Pay attention to reviews and recommendations from peers, friends, and family.

- Customer service and support: It is best to opt for a lender who offers clear, tailored advice and communication channels that suit your preferences, whether through chat functions or traditional phone calls.

- Flexibility and options: A great mortgage lender usually offers a variety of mortgage products and features, such as pre-approvals, flexible payment options and the opportunity to bundle with other financial products like chequing accounts or investments.

- Terms and conditions: In addition to the interest rate, scrutinize the mortgage terms, including amortization schedules, term lengths and any conditions that could affect the offered rate.

- Long-term relationship: Consider whether the lender is someone with whom you can establish a lasting relationship with. Your mortgage needs may change with time and having a lender willing to adapt and work with you can be advantageous.

Impact of rate hikes on monthly mortgage payments in Alberta

Due to the sudden BoC rate increases, many Alberta residents are concerned about being unable to afford a home. This is why it is very important to factor in potential rate increases when getting a mortgage.

Today, the lowest mortgage rates in Alberta are around 5%, and only a few years back they stood around 2.5%.

Let’s see how the rate hike would have impacted a $400,000 home using our Alberta mortgage calculator.

If you had put 20% down ($80,000) on a 5-year fixed rate mortgage for a $400,000 home five years ago. At 2.5%, your bi-weekly mortgage payment would have been $716.75.

Five years later, you’d end up paying $56,837.67 towards your principal, lowering your total amount owing to $261,662.33 with 20 years left on the term.

At a 5% rate of interest, your bi-weekly mortgage payment jumps to $859.73, or an extra $285.92 per month upon renewal. This is why it is important to have a long term plan when it comes to securing a mortgage type and term.

Using our Alberta mortgage calculator, you can see how different rates affect your mortgage monthly payments.

Understanding your Alberta mortgage closing costs

Final thoughts on finding the best mortgage rates in Alberta

If you're in the market for your first home, it's essential to be prepared for everything. As a homebuyer, you should focus on boosting your credit score and saving up for a larger down payment and closing costs. Having extra funds at your disposal can significantly smooth out the home-buying process. To further expedite the home buying process, obtaining pre-approval for your mortgage is key. When it comes time to secure your mortgage, take the time to shop around and compare both lenders and rates.

If you are considering renewing or financing your home, it is best to get started right away, allowing yourself to take time to weigh out all possible lenders and options. If you procrastinate, your current lender might lock you back in, taking away the freedom to explore other options. In this scenario, it’s always best to explore multiple rates and terms that align with your preferences and negotiate accordingly. You should never hesitate to switch lenders if necessary, but be mindful of any associated fees. If feasible, take the opportunity to reassess your financial objectives, consider making lump sum payments, and review your budget to determine whether adjusting the amortization period is necessary to better align with your financial goals.

Purchasing a home in Alberta is a long term investment and commitment and as a homebuyer you should always shop around when it comes to securing financing for your future home.

Alberta mortgage rate glossary

Basis points: A basis point is one-hundredth of a percentage point (0.01%). Think of basis points as a way to describe changes in interest rates and other financial percentages. For Alberta mortgage rates, a small change in basis points can significantly impact the total interest paid over the life of a mortgage. For instance, if your Alberta mortgage rate is 5% on a 25-year mortgage for a $300,000 house, a 25 basis point increase would raise your monthly payment from $1,746.03 to $1,788.85 (an increase of $42.82 per month).

Prime rate: The prime rate serves as the benchmark for banks' interest rates and is greatly influenced by the Bank of Canada's policy interest rate. Variations in variable and adjustable-rate mortgages occur due to changes in the prime rate. A higher prime rate means higher borrowing costs.

Amortization period: The amortization period refers to the total time required to fully repay a mortgage, assuming regular payments and no changes in the interest rate. Although it doesn't directly impact Alberta interest rates, a longer amortization results in higher interest payments. Shorter periods mean higher monthly payments but lower overall interest costs.

Debt-to-income ratio (DTI) or Gross-Debt-to-Income (GDI): DTI compares an individual's monthly debt payments to their gross monthly income. Lenders utilize DTI to evaluate borrowers' ability to manage payments and repay debts. A lower DTI often secures a better mortgage rate.

First-Time Home Buyer Savings Account (FHSA): A tax-advantaged Canadian savings account intended to help first-time homebuyers in saving for their first home. Your FHSA contributions are tax-deductible and any withdrawals your make for a first home purchase are tax-free.

Canada Mortgage and Housing Corporation (CMHC): A governmental body in Canada that enhances mortgage liquidity, contributing to a stable housing market and financial system. It offers mortgage loan insurance for high-ratio mortgages (those with less than a 20% down payment).

Loan-to-Value Ratio (LTV): LTV compares the loan amount to the property's appraised value or purchase price, expressed as a percentage. Lenders can use this to assess loan risk, with lower ratios indicating less risk for the lender.

Bond yields: Bond yields are the returns an investor receives on a bond and are calculated by dividing the annual interest payment by the bond's current market price. For fixed-rate bonds, yield moves inversely to price: as bond prices rise, yields fall and vice versa.

Lubna Umar has worked in the field of personal finance for over 5 years. She has produced a wide variety of content including personal finance guides and insurance reports for brands like RATESDOTCA and the Financial Post. In her free time, she can be found writing fiction or exploring the café culture in Toronto or any other major city.

Explore the latest articles

Ramit Sethi's money rules omit owning a home

Personal finance expert Ramit Sethi gets fired up when confronted with the view of home ownership being the ultimate wealth-building investment. Here are his 10 money rules

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.